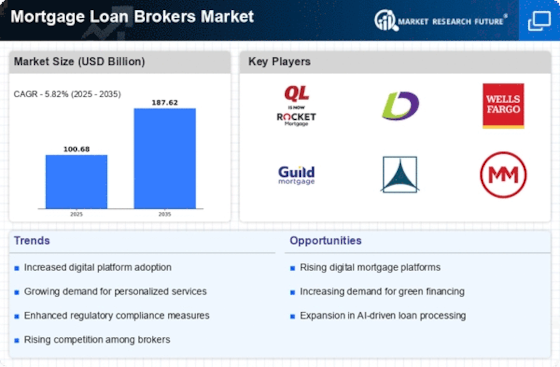

The Mortgage Loan Brokers Market is currently characterized by a dynamic competitive landscape, driven by factors such as technological advancements, evolving consumer preferences, and regulatory changes. Major players like Quicken Loans (US), LoanDepot (US), and Wells Fargo (US) are strategically positioning themselves to leverage these trends. Quicken Loans (US) has focused on enhancing its digital platform, aiming to streamline the mortgage application process, which appears to resonate well with tech-savvy consumers. Meanwhile, LoanDepot (US) has been expanding its footprint through strategic partnerships, thereby increasing its market reach and operational efficiency. Wells Fargo (US), on the other hand, has been concentrating on compliance and risk management, ensuring that its operations align with regulatory standards while maintaining customer trust. Collectively, these strategies contribute to a competitive environment that is increasingly reliant on innovation and customer-centric approaches.

The business tactics employed by these companies reflect a nuanced understanding of the market's structure, which is moderately fragmented. Key players are optimizing their operations through localized services and enhanced customer engagement strategies. This fragmentation allows for a diverse range of offerings, catering to various consumer segments, while the collective influence of these major players shapes market dynamics significantly. The emphasis on digital transformation and customer experience is becoming a common thread among these brokers, indicating a shift towards more personalized service delivery.

In August 2025, Quicken Loans (US) launched a new AI-driven mortgage calculator designed to provide potential borrowers with tailored loan options based on their financial profiles. This strategic move not only enhances user experience but also positions the company as a leader in leveraging technology to simplify the mortgage process. The integration of AI into their services suggests a commitment to innovation that could set a new standard in the industry.

In September 2025, LoanDepot (US) announced a partnership with a leading fintech company to develop a mobile application that facilitates real-time mortgage tracking for clients. This initiative is indicative of LoanDepot's strategy to enhance customer engagement and transparency, which may lead to increased customer loyalty and retention. By prioritizing mobile accessibility, LoanDepot appears to be aligning itself with the growing trend of digital-first consumer behavior.

In July 2025, Wells Fargo (US) implemented a new compliance framework aimed at improving its risk management processes. This strategic action underscores the bank's focus on regulatory adherence, which is crucial in maintaining its reputation and operational integrity. By investing in compliance technologies, Wells Fargo is likely to mitigate risks associated with lending practices, thereby reinforcing its market position.

As of October 2025, the Mortgage Loan Brokers Market is witnessing trends that emphasize digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are becoming increasingly pivotal, as companies seek to enhance their technological capabilities and customer offerings. The competitive differentiation is shifting from traditional price-based competition to a focus on innovation, technology, and supply chain reliability. This evolution suggests that companies that prioritize these aspects will likely emerge as leaders in the market, adapting to the changing landscape and consumer expectations.

Leave a Comment