Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards play a crucial role in shaping the mooring buoy Market. Governments and maritime authorities are increasingly enforcing stringent regulations to ensure the safety of marine operations. These regulations often mandate the use of certified mooring systems, which drives demand for high-quality mooring buoys. The market is witnessing a shift towards products that not only meet safety standards but also incorporate advanced materials and technologies. As a result, manufacturers are investing in research and development to create mooring solutions that comply with these regulations while enhancing operational efficiency. This focus on compliance is expected to bolster the growth of the Mooring Buoy Market in the coming years.

Growth of the Shipping and Logistics Sector

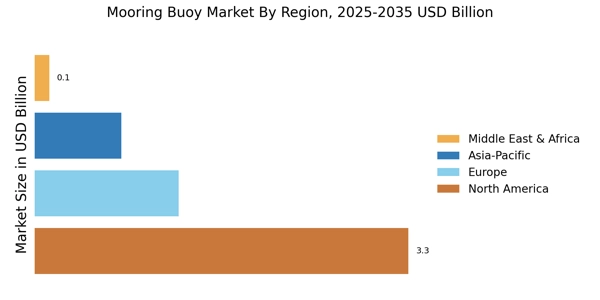

The growth of the shipping and logistics sector is a significant driver for the Mooring Buoy Market. With the increase in global trade and e-commerce, there is a heightened need for efficient port operations and logistics management. This growth translates into a higher demand for mooring solutions that can accommodate larger vessels and facilitate quicker turnaround times. Recent statistics indicate that the shipping industry is set to expand by approximately 4.5% annually, which will likely lead to increased investments in port infrastructure, including mooring buoys. Consequently, the Mooring Buoy Market is poised to benefit from this trend as stakeholders seek reliable and durable mooring systems to support their operations.

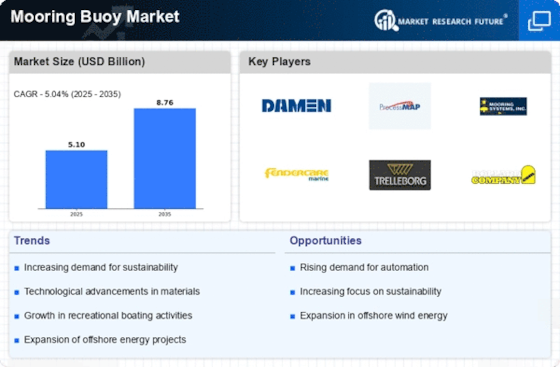

Increasing Demand for Marine Infrastructure

The rising demand for marine infrastructure is a pivotal driver in the Mooring Buoy Market. As coastal and maritime activities expand, the need for reliable mooring solutions becomes paramount. This trend is particularly evident in regions experiencing growth in shipping and tourism. According to recent data, the marine infrastructure sector is projected to grow at a compound annual growth rate of approximately 5.2% over the next five years. This growth is likely to spur investments in mooring systems, including buoys, to accommodate larger vessels and enhance safety. Consequently, manufacturers in the Mooring Buoy Market are expected to innovate and diversify their product offerings to meet the evolving needs of marine operators.

Technological Innovations in Mooring Systems

Technological innovations are reshaping the Mooring Buoy Market, driving advancements in design and functionality. The integration of smart technologies, such as IoT and automated monitoring systems, is enhancing the performance and reliability of mooring buoys. These innovations allow for real-time data collection and analysis, enabling operators to optimize mooring strategies and improve safety. Furthermore, the development of environmentally friendly materials is gaining traction, aligning with sustainability goals in the maritime sector. As these technologies continue to evolve, they are expected to create new opportunities for manufacturers in the Mooring Buoy Market, fostering competition and encouraging the adoption of cutting-edge solutions.

Expansion of Recreational and Commercial Boating

The expansion of recreational and commercial boating activities is a key driver in the Mooring Buoy Market. As more individuals and businesses engage in boating, the demand for reliable mooring solutions is increasing. This trend is particularly pronounced in regions with favorable weather conditions and access to water bodies. Recent data suggests that the recreational boating market is projected to grow at a rate of 3.8% annually, which will likely lead to a corresponding rise in the need for mooring buoys. Additionally, commercial boating operations, including fishing and tourism, are also expanding, further driving demand. As a result, manufacturers in the Mooring Buoy Market are focusing on developing versatile and durable mooring solutions to cater to this growing market.