Rising Adoption of 5G Technology

The Monolithic Microwave IC Market is significantly influenced by the rapid adoption of 5G technology. As telecommunications companies invest heavily in infrastructure to support 5G networks, the demand for high-performance microwave ICs is expected to escalate. These components are essential for enabling faster data rates and lower latency, which are critical for 5G applications. Market analysts suggest that the 5G rollout could lead to a market expansion of over 15% annually, as more devices become interconnected. This trend not only boosts the demand for monolithic microwave ICs but also encourages innovation in design and manufacturing processes, positioning companies to capitalize on the burgeoning 5G ecosystem.

Emergence of Automotive Radar Systems

The Monolithic Microwave IC Market is increasingly shaped by the emergence of automotive radar systems, which are essential for advanced driver-assistance systems (ADAS) and autonomous vehicles. As the automotive sector shifts towards greater automation and safety features, the demand for reliable microwave ICs is expected to rise. Analysts project that the automotive radar market could grow by over 20% in the next few years, creating a substantial opportunity for monolithic microwave IC manufacturers. This trend not only highlights the importance of these components in enhancing vehicle safety but also encourages innovation in their design and functionality, thereby driving the overall market forward.

Growth in Aerospace and Defense Sector

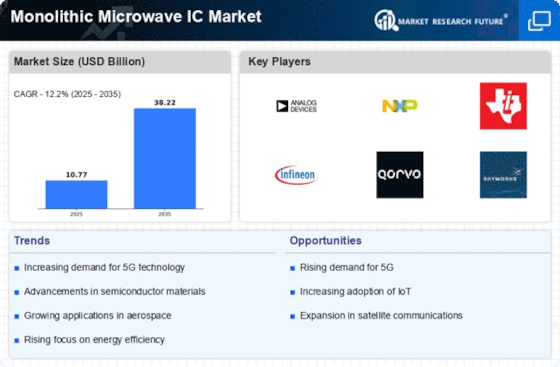

The Monolithic Microwave IC Market is witnessing substantial growth due to increased investments in the aerospace and defense sector. With the rising need for advanced communication systems, radar, and electronic warfare applications, the demand for high-performance microwave ICs is on the rise. The market is anticipated to grow by approximately 12% in the coming years, driven by government spending on defense technologies and modernization programs. This growth presents opportunities for manufacturers to develop specialized monolithic microwave ICs tailored for military applications, thereby enhancing their product offerings and market share. The strategic importance of these components in defense systems underscores their critical role in the industry.

Increasing Demand for High-Frequency Applications

The Monolithic Microwave IC Market is experiencing a surge in demand for high-frequency applications, particularly in telecommunications and radar systems. As industries increasingly rely on high-speed data transmission, the need for efficient microwave integrated circuits becomes paramount. The market is projected to grow at a compound annual growth rate of approximately 10% over the next five years, driven by advancements in 5G technology and the Internet of Things (IoT). This growth indicates a robust appetite for innovative solutions that can handle higher frequencies with improved performance. Consequently, manufacturers are focusing on developing more sophisticated monolithic microwave ICs that cater to these high-frequency requirements, thereby enhancing their market presence and competitiveness.

Technological Innovations in Semiconductor Manufacturing

The Monolithic Microwave IC Market is benefiting from technological innovations in semiconductor manufacturing processes. Advances in materials and fabrication techniques are enabling the production of more efficient and compact microwave ICs, which are crucial for various applications, including telecommunications and consumer electronics. The market is expected to see a growth rate of around 8% as manufacturers adopt new technologies such as GaN and SiGe, which offer superior performance characteristics. These innovations not only enhance the capabilities of monolithic microwave ICs but also reduce production costs, making them more accessible to a wider range of applications. This trend indicates a promising future for the industry as it adapts to evolving technological demands.