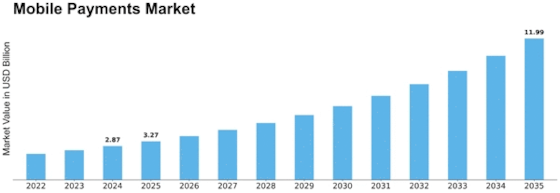

Mobile Payments Size

Mobile Payments Market Growth Projections and Opportunities

The Mobile Payments market has witnessed a transformative evolution, driven by the relentless growth of smartphone usage and the increasing demand for convenient, cashless transactions. Market dynamics in this sector are shaped by a multitude of factors, reflecting a complex interplay of technology, consumer behavior, and regulatory environments.

At the forefront of these dynamics is the rapid advancement of mobile technology. As smartphones become more sophisticated and widespread, their integration with payment solutions has become seamless. This has given rise to a competitive landscape where mobile payment providers continually strive to offer user-friendly and secure platforms. Innovations such as near-field communication (NFC), biometric authentication, and mobile wallets have not only enhanced the ease of transactions but have also fueled consumer trust in mobile payment systems.

Consumer behavior plays a pivotal role in shaping the market dynamics of mobile payments. The shift towards digital and contactless transactions is driven by the convenience, speed, and efficiency that mobile payments offer. The younger demographic, in particular, exhibits a strong preference for mobile payment methods, fostering a cultural shift towards cashless societies. Additionally, the ongoing global emphasis on hygiene and health in the wake of the COVID-19 pandemic has further accelerated the adoption of contactless payment methods, providing a tailwind to the mobile payments market.

The competitive landscape of the Mobile Payments market is characterized by a diverse array of players, ranging from traditional financial institutions to technology giants and startups. Established players leverage their existing customer base and infrastructure, while nimble startups bring innovative solutions to the table. Collaborations between traditional banks and fintech companies are increasingly common, reflecting a symbiotic relationship aimed at combining financial expertise with technological agility. These partnerships contribute to the dynamic ecosystem, fostering competition and innovation.

Regulatory environments significantly impact the trajectory of the mobile payments market. Governments and regulatory bodies play a crucial role in shaping the legal framework that governs digital transactions. Striking a balance between fostering innovation and ensuring consumer protection is a delicate task. Regulatory support can provide a conducive environment for market growth, offering clear guidelines and instilling confidence in both consumers and businesses. Conversely, stringent or ambiguous regulations can act as barriers to entry, hindering the expansion of mobile payment services.

Security concerns represent a persistent challenge within the mobile payments market dynamics. As the volume of digital transactions grows, so does the threat landscape. Cybersecurity measures and data protection become paramount in maintaining consumer trust. Market players continually invest in advanced security technologies, including encryption, tokenization, and biometric authentication, to safeguard user information and financial transactions.

Leave a Comment