Market Analysis

In-depth Analysis of Mobile Payment Technologies Market Industry Landscape

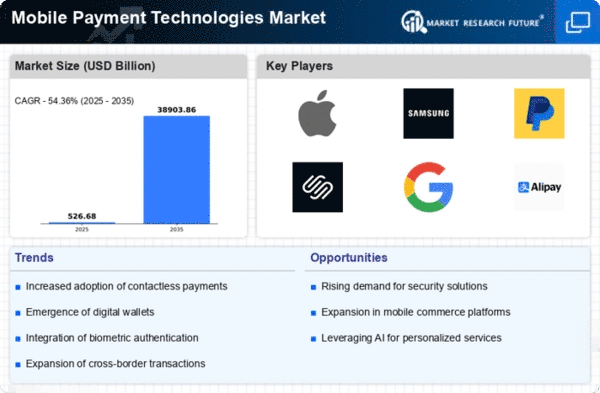

Mobile payment technologies market dynamics and growth are shaped by many key variables. Smartphone use worldwide is fueling mobile payment technology growth. Demand for mobile payment solutions rises as more people have smartphones. Digitalization and mobile payments also drive the industry.

The rising importance of payment security and convenience is another market aspect. Cyber risks and fraud are driving consumers and organizations to seek safe and efficient payment alternatives. Advanced security features in mobile payment technologies like biometric authentication and tokenization are favorably impacting the market.

Additionally, legislative changes shape the mobile payment technology industry. Data privacy, consumer protection, and interoperability laws affect mobile payment solution development and acceptance. These restrictions are crucial for mobile payment enterprises, and regulatory changes can drastically impact market dynamics.

Competitiveness and strategic collaborations affect mobile payment technology markets. Major players like IT, banks, and mobile network carriers boost competition and innovation. Strategic partnerships between industry players to improve products and increase market reach affect market growth.

Consumer tastes and behavior also shape the mobile payment technology industry. Mobile payment solutions have grown because to the worldwide COVID-19 epidemic and the need for smooth, contactless payments. To address customer demands for ease and flexibility in financial transactions, the industry develops new payment technologies.

Artificial intelligence, machine learning, and IoT integration into mobile payment systems also affects the industry. These technologies offer tailored and predictive payments, increasing consumer happiness. These advances in mobile payment systems are changing the industry and user uptake.

GDP growth, disposable income, and consumer buying patterns also affect mobile payment technology. As economies flourish and consumer purchasing power rises, need for efficient and secure payment systems drives market growth.

Leave a Comment