Top Industry Leaders in the Mobile Payment Technologies Market

Competitive Landscape of Mobile Payment Technologies Market

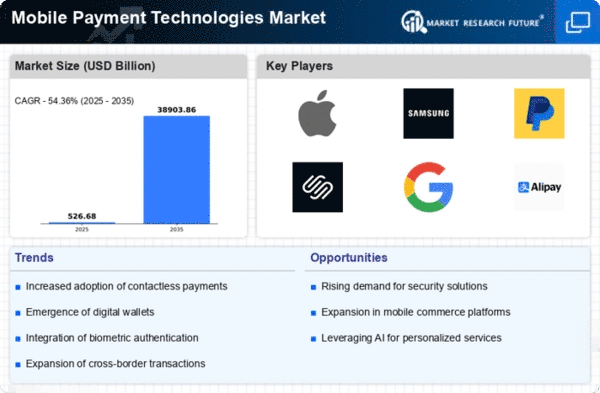

The mobile payment technologies market is experiencing explosive growth, fueled by the increasing penetration of smartphones, rising internet connectivity, and evolving consumer preferences. This dynamic landscape is characterized by intense competition, with established players jostling for market share alongside emerging disruptors. Understanding the competitive dynamics is crucial for any company seeking to navigate and thrive in this fast-paced environment.

Key Players:

-

American Express Company (US)

-

Money Gram International (US)

-

Google (US)

-

Visa Inc. (US)

-

PayPal Holdings Inc. (US)

-

M Pesa (India)

-

Samsung Electronics Co. Ltd. (South Korea)

-

WeChat (China)

-

BlueSnap (US)

-

Global Payments (US)

-

Paytm (India)

-

Worldpay (US)

-

PayU (Netherlands)

-

Dwolla (US)

-

Novatti (Australia)

-

Wirecard (Germany)

-

ACI Worldwide (US)

-

Six Payment Services (Switzerland)

-

Fiserv (US)

-

Paysafe (UK)

Strategies Adopted:

-

Focus on User Experience: Intuitive interfaces, secure transactions, and integration with existing ecosystems are key to attracting and retaining users.

-

Partnerships and Collaborations: Partnering with retailers, banks, and other service providers expands reach and offers a wider range of payment options.

-

Innovation and Differentiation: Developing new features like loyalty programs, in-app payments, and biometric authentication helps stand out in a crowded market.

-

Geopolitical Considerations: Adapting to local regulations, cultural preferences, and payment infrastructure is crucial for success in diverse markets.

-

Investment in Technology: Continuous investment in blockchain, AI, and other emerging technologies is essential for staying ahead of the curve.

Factors for Market Share Analysis:

-

Transaction Volume and Value: Understanding the volume and value of transactions processed by each player provides insights into market share and revenue generation.

-

User Base and Growth: The number of active users and the rate of user acquisition are crucial indicators of a platform's reach and potential.

-

Geographic Presence: The geographical reach and market penetration in different regions significantly impact overall market share.

-

Merchant Adoption: The number and type of merchants accepting a specific payment method reflects its market acceptance and potential.

-

Technological Advancements: Offering innovative features and integrating with emerging technologies can give a competitive edge.

New and Emerging Companies:

-

Cryptocurrency-based Payment Solutions: Companies like Coinbase and Binance are exploring blockchain-powered payment solutions offering faster, cheaper, and more secure transactions.

-

Biometric Authentication Providers: Companies like Fingerprint Cards and Synaptics are developing advanced fingerprint and facial recognition technologies for secure mobile payments.

-

AI-powered Payment Platforms: Companies like Plaid and Finicity are leveraging AI to personalize payment experiences, analyze user behavior, and prevent fraud.

-

Open Banking Platforms: Companies like Tink and TrueLayer are enabling third-party developers to access financial data and build innovative payment solutions.

Current Company Investment Trends:

-

Focus on Emerging Markets: Companies are investing heavily in expanding their reach in developing markets with high mobile penetration and unbanked populations.

-

Building Ecosystems: Players are creating comprehensive ecosystems that integrate payments with other services like loyalty programs, data analytics, and financial management tools.

-

Partnerships and Acquisitions: Strategic partnerships and acquisitions are common, allowing companies to expand their offerings, enter new markets, and acquire valuable technology and expertise.

-

Focus on Security and Compliance: Companies are investing in robust security infrastructure and compliance with evolving regulations to build trust and safeguard user data.

Latest Company Updates:

-

Jan 18, 2024: Apple Pay expands to 4 new markets in Central Asia: Kazakhstan, Kyrgyzstan, Tajikistan, and Uzbekistan.

-

Jan 12, 2024: PayPal partners with Western Union for international money transfers: Enables users to send and receive money in over 200 countries and territories.

-

Dec 21, 2023: Google Pay launches "Tap to Pay" feature in the US: Allows Android users to accept contactless payments on their smartphones.

-

Nov 30, 2023: China's Digital Yuan pilot expands to 17 major cities: Furthering the adoption of central bank digital currencies (CBDCs) in mobile payments.