Mobile Cobots Market Summary

As per Market Research Future analysis, the Mobile Cobots Market Size was estimated at 0.62 USD Billion in 2024. The Mobile Cobots industry is projected to grow from USD 0.7591 Billion in 2025 to USD 5.749 Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 22.44% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Mobile Cobots Market is experiencing robust growth driven by technological advancements and increasing demand for flexible automation.

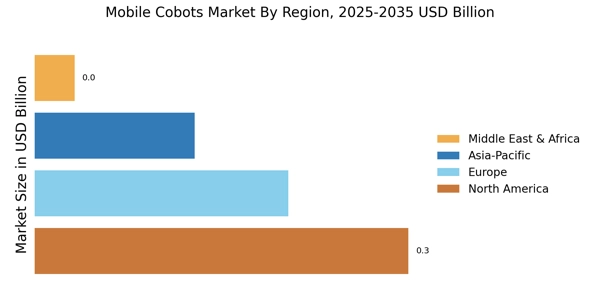

- The market is witnessing increased adoption in manufacturing, particularly in North America, which remains the largest market.

- Expansion into new industries is evident, with Asia-Pacific emerging as the fastest-growing region for mobile cobots.

- There is a heightened focus on safety and compliance, influencing the design and deployment of collaborative robots.

- Technological advancements in robotics and rising labor costs are key drivers propelling the demand for mobile cobots, especially in the 5 to 10kg segment.

Market Size & Forecast

| 2024 Market Size | 0.62 (USD Billion) |

| 2035 Market Size | 5.749 (USD Billion) |

| CAGR (2025 - 2035) | 22.44% |

Major Players

Mobile Industrial Robots (DK), Fetch Robotics (US), Omron Adept Technologies (US), Locus Robotics (US), Cobalt Robotics (US), Adept Technology (US), KUKA (DE), Yaskawa Electric Corporation (JP), Universal Robots (DK)