Shift Towards Rental Models

The Mini Excavator Rental Market is experiencing a paradigm shift as more construction firms and contractors opt for rental models over ownership. This trend is driven by the desire to minimize capital expenditures and maintenance costs associated with owning heavy machinery. In 2025, it is estimated that the rental market for construction equipment, including mini excavators, will account for approximately 30% of the total equipment market. This shift is particularly pronounced among small to medium-sized enterprises that may lack the financial resources to invest in new equipment. Renting allows these companies to access the latest technology and equipment without the long-term financial commitment. As this trend continues, the Mini Excavator Rental Market is likely to see increased participation from a diverse range of clients, further solidifying its position in the construction ecosystem.

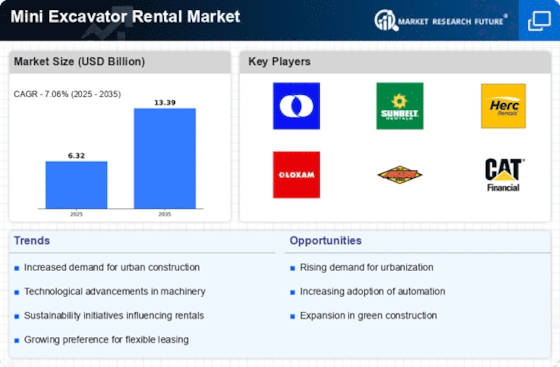

Increased Construction Activities

The Mini Excavator Rental Market is experiencing a surge in demand due to heightened construction activities across various sectors. As urban areas expand and infrastructure projects proliferate, the need for efficient and compact machinery becomes paramount. In 2025, the construction sector is projected to grow at a rate of approximately 5.5% annually, driving the rental market for mini excavators. These machines are favored for their versatility and ability to operate in confined spaces, making them ideal for urban construction sites. Furthermore, the trend towards modular construction and renovation projects further fuels the demand for mini excavators, as contractors seek to optimize their equipment usage without the burden of ownership costs. This trend indicates a robust future for the Mini Excavator Rental Market as it aligns with the evolving needs of the construction landscape.

Rising Demand for Landscaping Services

The Mini Excavator Rental Market is witnessing a notable increase in demand for landscaping services, which is contributing to the growth of the rental sector. As residential and commercial properties increasingly prioritize aesthetic appeal, landscaping projects have become more prevalent. In 2025, the landscaping services market is expected to expand significantly, with a projected growth rate of around 4.2%. Mini excavators are particularly well-suited for landscaping tasks, such as grading, digging, and planting, due to their compact size and maneuverability. This trend suggests that rental companies specializing in mini excavators may see a rise in clientele from landscaping firms, as these businesses often prefer renting over purchasing equipment to manage costs effectively. Consequently, the Mini Excavator Rental Market stands to benefit from this growing demand for professional landscaping services.

Technological Innovations in Equipment

The Mini Excavator Rental Market is benefiting from rapid technological innovations that enhance the performance and efficiency of mini excavators. Advancements such as telematics, improved fuel efficiency, and enhanced safety features are making these machines more appealing to contractors and rental companies alike. In 2025, it is anticipated that the integration of smart technology in construction equipment will lead to a 15% increase in operational efficiency. This trend not only improves productivity on job sites but also reduces operational costs, making rental options more attractive. As contractors seek to leverage these technological advancements, the Mini Excavator Rental Market is likely to see a rise in demand for modern, technologically equipped machines. This evolution indicates a promising future for the rental sector as it adapts to the changing landscape of construction technology.

Focus on Sustainability and Eco-Friendly Practices

The Mini Excavator Rental Market is increasingly influenced by a growing focus on sustainability and eco-friendly practices within the construction sector. As environmental regulations become more stringent, contractors are seeking equipment that minimizes their carbon footprint. Mini excavators, particularly those powered by alternative fuels or electric engines, are gaining traction as sustainable options. In 2025, the market for eco-friendly construction equipment is projected to grow by approximately 20%, reflecting a shift in industry priorities. This trend encourages rental companies to expand their fleets to include more environmentally friendly options, catering to the demands of eco-conscious clients. Consequently, the Mini Excavator Rental Market is poised to thrive as it aligns with the broader movement towards sustainable construction practices.