Global Security Threats

The Global Military Helicopter Market Industry is propelled by escalating global security threats, including terrorism and regional conflicts. Nations are compelled to enhance their defense capabilities to address these challenges, leading to increased investments in military aviation. The need for rapid deployment and versatile aerial support has made helicopters indispensable in modern warfare. As countries respond to evolving threats, the demand for advanced military helicopters is projected to rise. This trend is particularly pronounced in regions facing instability, where governments prioritize military readiness. The market's growth trajectory is expected to align with these security dynamics, reinforcing the strategic importance of military helicopters.

Market Growth Projections

The Global Military Helicopter Market Industry is poised for substantial growth, with projections indicating a market size of 89.2 USD billion by 2035. This growth is underpinned by a compound annual growth rate (CAGR) of 9.76% from 2025 to 2035. The increasing demand for advanced military helicopters, driven by modernization efforts and evolving security threats, is expected to fuel this expansion. As nations invest in upgrading their aerial capabilities, the market is likely to attract significant investments from both public and private sectors. This positive outlook reflects the strategic importance of military helicopters in contemporary defense strategies and operational frameworks.

Rising Asymmetric Warfare

The Global Military Helicopter Market Industry is significantly influenced by the rise of asymmetric warfare, which necessitates versatile and agile aerial platforms. As conflicts evolve, military forces are increasingly relying on helicopters for rapid response, troop transport, and close air support. This shift is evident in various operational theaters where helicopters are deployed for counterinsurgency and anti-terrorism missions. The demand for multi-role helicopters capable of adapting to diverse combat scenarios is expected to drive market growth. Consequently, manufacturers are focusing on developing helicopters that can operate effectively in complex environments, thereby enhancing their market presence and contributing to the industry's expansion.

Increasing Defense Budgets

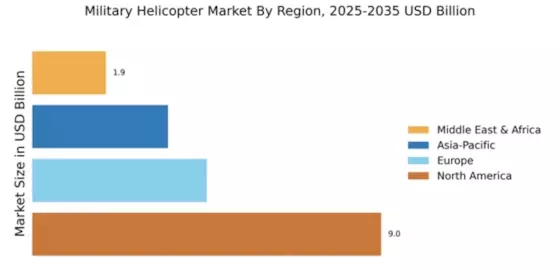

The Global Military Helicopter Market Industry is experiencing a notable surge due to rising defense budgets across various nations. Countries are prioritizing military modernization and enhancing their aerial capabilities, leading to increased procurement of advanced helicopters. For instance, in 2024, global defense spending is projected to reach approximately 32 USD billion, reflecting a commitment to bolster military readiness. This trend is particularly evident in regions like Asia-Pacific and Europe, where geopolitical tensions drive nations to invest heavily in their defense sectors. As a result, the demand for military helicopters is expected to grow significantly, contributing to the overall expansion of the market.

Technological Advancements

Technological advancements play a pivotal role in shaping the Global Military Helicopter Market Industry. Innovations in avionics, materials, and propulsion systems enhance the performance and capabilities of military helicopters. For example, the integration of advanced sensors and communication systems improves situational awareness and operational efficiency. These developments not only increase the effectiveness of military operations but also attract investments from defense contractors. As nations seek to maintain a technological edge, the market is likely to witness a robust growth trajectory, with projections indicating a market size of 89.2 USD billion by 2035. This growth underscores the importance of continuous innovation in military aviation.

International Collaborations and Partnerships

International collaborations and partnerships are emerging as a key driver in the Global Military Helicopter Market Industry. Countries are increasingly engaging in joint ventures and cooperative programs to enhance their military capabilities. These collaborations facilitate technology transfer, cost-sharing, and access to advanced systems. For instance, partnerships between nations and defense contractors enable the development of next-generation helicopters tailored to specific operational needs. Such initiatives not only strengthen defense ties but also stimulate market growth by expanding the range of available platforms. As nations recognize the benefits of collaboration, the military helicopter sector is likely to witness increased activity, contributing to its overall expansion.