Enhanced Development Speed

In the Microservices Architecture Market, the emphasis on rapid application development is becoming increasingly pronounced. Organizations are adopting microservices to accelerate their development cycles, enabling teams to work on different components simultaneously. This approach not only reduces time-to-market but also fosters innovation. Data indicates that companies leveraging microservices can achieve a 40% reduction in development time. The ability to deploy updates frequently and reliably is a critical factor driving this trend. As businesses strive to deliver new features and improvements at a faster pace, the Microservices Architecture Market is likely to witness sustained growth, reflecting the demand for agile development methodologies.

Increased Focus on Security

Security concerns are becoming a pivotal driver in the Microservices Architecture Market. As organizations migrate to microservices, they face unique security challenges that necessitate robust solutions. The distributed nature of microservices can expose vulnerabilities, prompting businesses to invest in advanced security measures. Recent studies suggest that organizations implementing microservices with integrated security protocols experience a 25% decrease in security incidents. This heightened focus on security not only protects sensitive data but also builds customer trust. Consequently, the Microservices Architecture Market is evolving to incorporate security as a fundamental aspect of architecture design, ensuring that businesses can operate securely in a digital landscape.

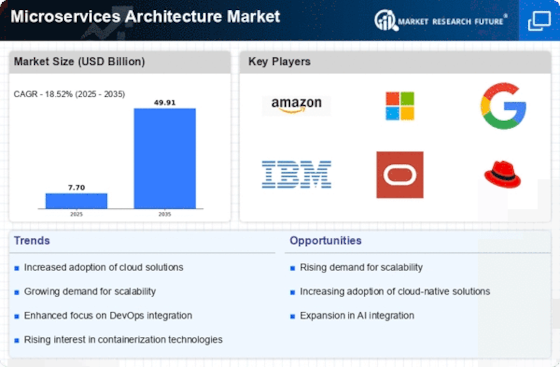

Growing Demand for Scalability

The Microservices Architecture Market is experiencing a notable surge in demand for scalable solutions. Organizations are increasingly seeking architectures that can efficiently handle varying workloads and user demands. This trend is driven by the need for businesses to remain agile and responsive to market changes. According to recent data, companies utilizing microservices report a 30% improvement in scalability compared to traditional monolithic architectures. As businesses expand, the ability to scale applications seamlessly becomes paramount, thereby propelling the growth of the Microservices Architecture Market. Furthermore, the flexibility offered by microservices allows organizations to deploy updates and new features independently, enhancing overall operational efficiency.

Rising Adoption of Containerization

The Microservices Architecture Market is witnessing a significant rise in the adoption of containerization technologies. Containers facilitate the deployment and management of microservices, allowing for greater consistency across development and production environments. This trend is largely driven by the need for efficient resource utilization and simplified deployment processes. Data shows that organizations utilizing container orchestration platforms report a 50% improvement in deployment efficiency. As businesses increasingly recognize the benefits of containerization, the Microservices Architecture Market is likely to expand, reflecting the growing integration of these technologies into microservices strategies.

Demand for Improved Customer Experience

The Microservices Architecture Market is significantly influenced by the demand for enhanced customer experiences. Organizations are leveraging microservices to create more personalized and responsive applications. By breaking down applications into smaller, manageable services, businesses can tailor functionalities to meet specific customer needs. This approach not only improves user satisfaction but also fosters customer loyalty. Recent market analysis indicates that companies adopting microservices report a 35% increase in customer engagement metrics. As the competition intensifies, the Microservices Architecture Market is expected to grow, driven by the imperative to deliver superior customer experiences through innovative application design.