North America : Innovation and Investment Hub

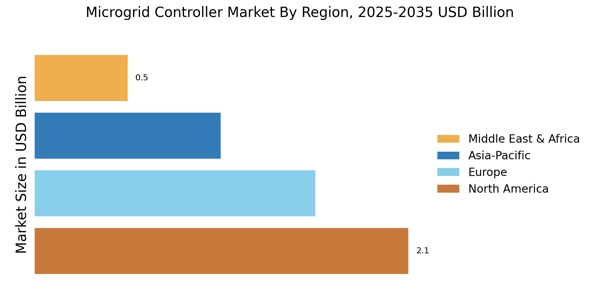

North America is the largest market for microgrid controllers, holding approximately 40% of the global market share. The region hosts several leading controller manufacturers such as General Electric, Schneider Electric, and Honeywell. The region's growth is driven by increasing investments in renewable energy, government incentives, and a strong focus on energy resilience. Regulatory frameworks, such as the Federal Energy Regulatory Commission's initiatives, further catalyze market expansion, promoting decentralized energy solutions and smart grid technologies.

The United States is the dominant player in this region, with significant contributions from Canada. Key players like General Electric, Schneider Electric, and Honeywell are actively involved in developing advanced microgrid solutions. The competitive landscape is characterized by innovation and strategic partnerships, enhancing the region's position as a leader in microgrid technology.

Europe : Sustainable Energy Transition Leader

Europe is the second-largest market for microgrid control systems, accounting for approximately 30% of the global market share. Companies like Siemens and ABB are among the prominent micro grid companies driving adoption. The region's growth is fueled by stringent environmental regulations, a commitment to reducing carbon emissions, and increasing investments in renewable energy sources. The European Union's Green Deal and various national policies are pivotal in driving the adoption of microgrid technologies, promoting energy efficiency and sustainability.

Leading countries in this region include Germany, the UK, and France, where significant investments in smart grid infrastructure are being made. Major players like Siemens and ABB are at the forefront, collaborating with local governments and organizations to enhance energy management systems. The competitive landscape is marked by innovation and a strong focus on integrating renewable energy sources into microgrid solutions.

Asia-Pacific : Emerging Market with High Potential

Asia-Pacific is witnessing rapid growth in the microgrid controller market, holding approximately 20% of the global market share. India and China are investing heavily in microgrid controllers for rural electrification and renewable integration. The region's expansion is driven by increasing energy demand, urbanization, and government initiatives aimed at enhancing energy security.

India is emerging as a key player in this market, with significant projects aimed at rural electrification and renewable energy deployment. The competitive landscape includes local and international players, with companies like Rockwell Automation and S&C Electric Company actively participating. The region's focus on sustainable energy solutions positions it as a promising market for microgrid controllers in the coming years.

Middle East and Africa : Resource-Rich Market Opportunities

The Middle East and Africa region is gradually emerging in the microgrid controller market, holding about 10% of the global market share. The growth is driven by the need for energy diversification, particularly in resource-rich countries. Governments are increasingly recognizing the importance of microgrids for enhancing energy security and sustainability, leading to supportive policies and investments in renewable energy projects. Countries like South Africa and the UAE are leading the charge, with initiatives aimed at integrating renewable energy into their grids. The competitive landscape is evolving, with both local and international players, including Microgrid Energy, seeking to capitalize on the growing demand for microgrid solutions. The region's unique energy challenges present significant opportunities for innovation and investment in microgrid technologies.