Top Industry Leaders in the Microencapsulated Pesticides Market

Microencapsulated Pesticides Market

Microencapsulated Pesticides Market

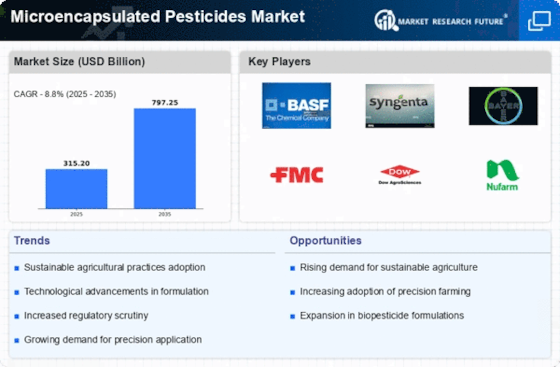

The competitive landscape of the microencapsulated pesticides market is dynamic and evolving, driven by the increasing demand for sustainable and efficient agricultural practices. This sector is characterized by a multitude of players, each striving to gain a competitive edge through innovation, strategic partnerships, and market expansion. The market's growth is influenced by several factors, including technological advancements, regulatory frameworks, and the emergence of new entrants. Analyzing the competitive scenario involves evaluating key players, their strategies, market share factors, and investment trends, as well as staying abreast of industry news and developments.

Key Players and Market Dominance:

- BASF SE (Germany)

- Bayer Cropscience AG (Germany)

- The DOW Chemical Company (US)

- The Monsanto Company (US)

- Syngenta AG (Switzerland)

- FMC Corporation (US)

- ADAMA Agricultural Solutions Ltd. (Israel)

- Belchim Crop Protection (Belgium)

- Reed Pacific Pty Limited (Australia)

- UPL Corporation Ltd. (India)

- EcoSafe Natural Products Inc. (Canada)

- GAT Microencapsulation Gmbh (Austria)

- China National Chemical Corporation (China)

- McLaughlin Gormley King Company (US)

- and BotanoCap Ltd. (Israel)

Strategies Adopted: The strategies adopted by key players in the microencapsulated pesticides market are multifaceted. Companies are increasingly focusing on research and development to create innovative formulations that enhance the efficacy and safety of pesticides. Strategic collaborations and partnerships are also prevalent, allowing companies to leverage each other's strengths and expand their market presence. Furthermore, there is a growing emphasis on sustainable and eco-friendly solutions, aligning with the global shift towards environmentally conscious practices.

Factors for Market Share Analysis: Market share analysis in the microencapsulated pesticides industry involves evaluating various factors. The efficacy of formulations, regulatory compliance, distribution networks, and brand reputation play crucial roles in determining a company's market share. Companies investing in cutting-edge technologies for microencapsulation and those with a strong commitment to sustainable practices are gaining traction. Additionally, geographical presence and the ability to adapt to changing market dynamics are pivotal for maintaining or expanding market share.

New and Emerging Companies: The microencapsulated pesticides market is witnessing the entry of several new and emerging companies seeking to disrupt the traditional landscape. These companies often bring fresh perspectives and innovative technologies. Examples include Marrone Bio Innovations, Inc., a company known for its focus on bio-based pest management solutions, and Vestaron Corporation, which specializes in peptide-based biopesticides. These newcomers are challenging established players by offering alternative, eco-friendly solutions that resonate with the growing demand for sustainable agriculture.

Industry News and Developments: Keeping abreast of industry news and developments is crucial in understanding the competitive landscape. Recent trends include a shift towards biological microencapsulated pesticides, increased emphasis on precision agriculture, and advancements in nanotechnology for improved encapsulation techniques. Regulatory updates, such as changes in pesticide registration requirements, also impact the competitive scenario. Industry stakeholders must stay informed to anticipate market shifts and adapt their strategies accordingly.

Current Company Investment Trends: Investment trends in the microencapsulated pesticides market reflect the industry's evolution. Companies are allocating significant funds to research and development, aiming to create novel formulations with enhanced performance and reduced environmental impact. Investments in sustainable practices, including biodegradable encapsulation materials, are gaining traction. Moreover, strategic acquisitions and partnerships are common, enabling companies to diversify their product portfolios and strengthen their market positions.

Overall Competitive Scenario: The overall competitive scenario in the microencapsulated pesticides market is characterized by a delicate balance between established industry leaders and innovative newcomers. While key players maintain dominance through extensive resources and global reach, emerging companies are carving out niches with specialized, environmentally friendly solutions. The market's trajectory is heavily influenced by technological advancements and regulatory dynamics, creating opportunities for companies that can adapt swiftly. The push for sustainable agriculture is reshaping the competitive landscape, with companies aligning their strategies to meet evolving consumer and regulatory demands.

The competitive landscape of the microencapsulated pesticides market reflects a dynamic and evolving industry, influenced by technological innovations, regulatory shifts, and the global emphasis on sustainable agriculture. Key players such as Bayer CropScience, Syngenta, and BASF continue to dominate through extensive portfolios and global reach, while new entrants like Marrone Bio Innovations and Vestaron bring fresh, eco-friendly perspectives. Market share analysis considers factors like formulation efficacy, regulatory compliance, and distribution networks. Industry news and investment trends highlight the ongoing shift towards sustainable practices, with companies focusing on research and development, strategic partnerships, and acquisitions. The overall competitive scenario is a delicate balance between established giants and innovative disruptors, creating a landscape that demands adaptability and foresight from industry stakeholders.

Bayer CropScience:

December 15, 2023: Announced successful field trials of its new microencapsulated insecticide for controlling thrips in greenhouse-grown strawberries, showing promising results in pest control and crop protection.

October 26, 2023: Partnered with a leading university to develop new microencapsulation technologies for slow-release and targeted delivery of biocontrol agents.

BASF:

January 9, 2024: Received regulatory approval in Brazil for its innovative microencapsulated fungicide, offering extended protection against fungal diseases in soybean and corn crops.

November 8, 2023: Launched its next-generation microencapsulation platform, enabling the development of customized microencapsulated pesticides for specific crop and pest needs.

Corteva Agriscience:

December 19, 2023: Unveiled its latest microencapsulated herbicide at the American Society of Agronomy Annual Meeting, showcasing its commitment to precision weed control solutions.

September 20, 2023: Signed a collaboration agreement with a prominent startup specializing in biodegradable microencapsulation materials, promoting sustainable technology development.

NanoSpectra Biosciences: In December 2023, NanoSpectra received funding from a major venture capital firm to expand its production capacity for its unique clay-based microencapsulation technology.

Valent BioSciences: In October 2023, Valent launched its first microencapsulated bioinsecticide, offering enhanced biocontrol with reduced environmental impact.