Rising Incidence of Infectious Diseases

The increasing prevalence of infectious diseases is a primary driver for the Microbial Identification Market. As pathogens evolve and new strains emerge, the demand for rapid and accurate microbial identification becomes critical. According to recent data, the incidence of infectious diseases has risen significantly, necessitating advanced diagnostic tools. This trend is particularly evident in healthcare settings, where timely identification of pathogens can lead to improved patient outcomes and reduced healthcare costs. The Microbial Identification Market is thus witnessing a surge in demand for innovative solutions that can provide quick and reliable results, enabling healthcare professionals to make informed decisions. Furthermore, the rise in antibiotic resistance highlights the need for precise identification of microbial species, further propelling the market forward.

Regulatory Compliance and Standardization

Regulatory frameworks and standardization initiatives are pivotal in shaping the Microbial Identification Market. Governments and health organizations are establishing guidelines to ensure the safety and efficacy of microbial testing methods. Compliance with these regulations is essential for laboratories and manufacturers, driving the demand for reliable microbial identification solutions. The market is witnessing a shift towards standardized testing protocols, which enhances the credibility of results and fosters consumer confidence. As regulatory bodies continue to emphasize the importance of microbial safety, the Microbial Identification Market is expected to grow, with companies investing in technologies that meet these stringent requirements. This trend underscores the critical role of regulatory compliance in advancing the market.

Growing Demand in Food and Beverage Industry

The food and beverage sector is increasingly prioritizing microbial safety, which significantly influences the Microbial Identification Market. With rising consumer awareness regarding foodborne illnesses, manufacturers are compelled to implement stringent quality control measures. The market for microbial identification solutions is expanding as companies seek to ensure the safety and quality of their products. Recent statistics indicate that foodborne pathogens contribute to millions of illnesses annually, prompting the need for effective microbial testing. Consequently, the Microbial Identification Market is experiencing growth as food manufacturers adopt advanced identification methods to comply with regulatory standards and maintain consumer trust. This trend is expected to continue, with an increasing focus on traceability and transparency in food production.

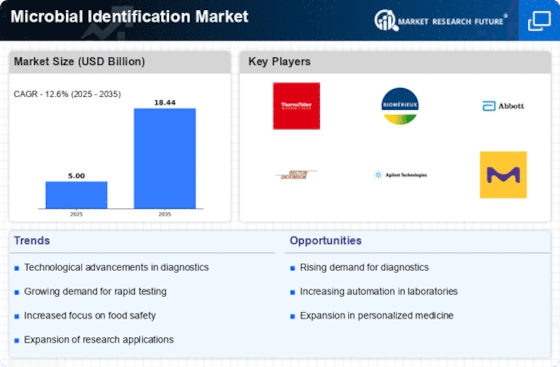

Technological Innovations in Diagnostic Tools

Technological advancements are reshaping the landscape of the Microbial Identification Market. Innovations such as next-generation sequencing, mass spectrometry, and polymerase chain reaction (PCR) techniques are enhancing the accuracy and speed of microbial identification. These technologies allow for the detection of a wide range of microorganisms, including bacteria, viruses, and fungi, in various samples. The market is projected to grow as these advanced tools become more accessible and affordable for laboratories and healthcare facilities. Moreover, the integration of artificial intelligence and machine learning in diagnostic processes is expected to streamline workflows and improve diagnostic accuracy. As a result, the Microbial Identification Market is likely to expand, driven by the continuous evolution of diagnostic technologies.

Expansion of Research and Development Activities

The Microbial Identification Market is benefiting from a surge in research and development activities across various sectors. Academic institutions, pharmaceutical companies, and biotechnology firms are investing in R&D to explore new microbial species and their potential applications. This focus on innovation is driving the demand for advanced microbial identification techniques, as researchers require precise tools to study microbial behavior and interactions. Furthermore, the rise of personalized medicine and targeted therapies is creating a need for accurate microbial identification in clinical settings. As R&D efforts intensify, the Microbial Identification Market is likely to see increased investment and growth, fostering the development of novel identification methods and technologies.