Diverse Content Offerings

The internet radio market in Mexico is characterized by a wide array of content that caters to various demographics and interests. From music genres to talk shows and podcasts, the diversity of programming appeals to a broad audience. This variety not only attracts listeners but also encourages advertisers to target specific segments effectively. As of 2025, the market has seen a notable increase in niche content, which has contributed to a rise in listener loyalty. This trend suggests that as more unique content becomes available, the internet radio market will likely continue to expand, drawing in both new listeners and advertisers seeking to capitalize on specific audience segments.

Technological Advancements

Technological innovations play a crucial role in shaping the internet radio market in Mexico. The advent of high-speed internet, improved streaming technologies, and enhanced audio quality have transformed the listening experience. As of 2025, advancements in artificial intelligence and machine learning are being utilized to personalize content recommendations, making it easier for users to discover new stations and shows. These technologies not only improve user engagement but also provide valuable data to advertisers, enabling them to refine their strategies. The continuous evolution of technology is likely to propel the internet radio market forward, fostering a more interactive and engaging environment for listeners.

Growing Internet Penetration

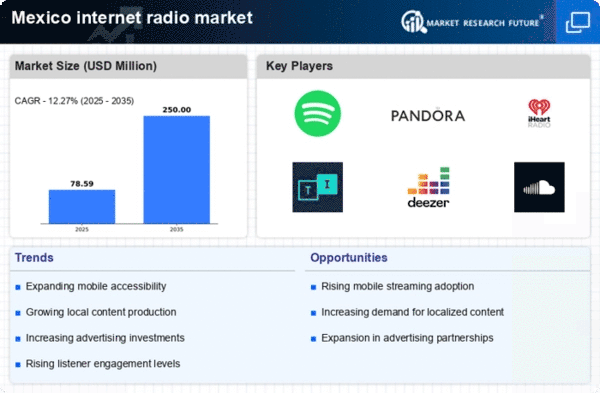

The expansion of internet access in Mexico is a pivotal driver for the internet radio market. As of 2025, approximately 80% of the population has access to the internet, a significant increase from previous years. This surge in connectivity facilitates the consumption of digital content, including internet radio. The proliferation of affordable smartphones and data plans has further contributed to this trend, allowing users to stream audio content seamlessly. Consequently, the internet radio market is likely to experience substantial growth as more individuals gain access to online platforms. The increasing number of internet users is expected to enhance listener engagement, thereby attracting advertisers and content creators to invest in this medium.

Increasing Advertising Revenue

The internet radio market in Mexico is experiencing a notable increase in advertising revenue, driven by the growing listener base and the effectiveness of targeted advertising. As of 2025, advertising spending in the internet radio sector is projected to reach $150 million, reflecting a robust growth trajectory. Advertisers are increasingly recognizing the value of reaching audiences through digital platforms, where they can leverage data analytics to tailor their messages. This trend indicates that as more brands invest in internet radio advertising, the market will likely expand further, creating a more competitive landscape that benefits both content creators and listeners.

Shift Towards On-Demand Content

The internet radio market is witnessing a shift towards on-demand content consumption in Mexico. Listeners increasingly prefer the flexibility of choosing when and what to listen to, moving away from traditional radio schedules. This trend is reflected in the growing popularity of podcasts and curated playlists, which allow users to tailor their listening experiences. As of 2025, it is estimated that on-demand audio content accounts for over 30% of total internet radio consumption in the country. This shift not only enhances user satisfaction but also presents opportunities for advertisers to create targeted campaigns that align with listener preferences, thereby driving growth in the internet radio market.