Increased Regulatory Compliance Requirements

The hybrid integration platform market in Mexico is also influenced by the increased regulatory compliance requirements across various sectors. Organizations are facing mounting pressure to adhere to data protection regulations and industry standards. This has led to a heightened focus on integrating compliance measures into their operational frameworks. As a result, companies are investing in hybrid integration platforms that can facilitate compliance while ensuring data security. The market is projected to grow as businesses seek solutions that not only streamline operations but also help them navigate the complex landscape of regulatory requirements.

Rising Need for Enhanced Customer Experience

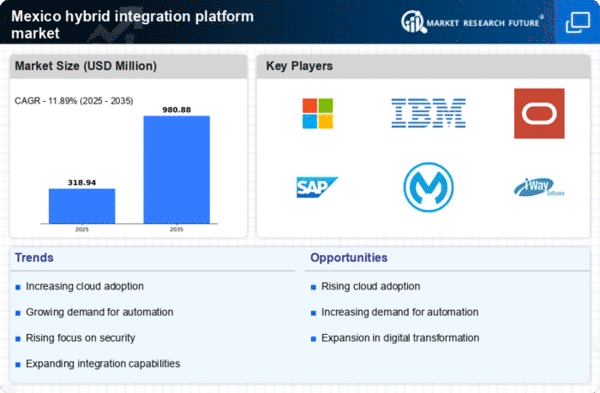

The hybrid integration-platform market is being propelled by the rising need for enhanced customer experience in Mexico. Companies are increasingly focusing on delivering personalized services and seamless interactions across multiple channels. This trend necessitates the integration of various customer touchpoints, which can be effectively achieved through hybrid integration platforms. As organizations strive to meet customer expectations, the market is likely to witness a growth rate of around 12% annually. The emphasis on customer-centric strategies is expected to drive investments in integration solutions, thereby benefiting the hybrid integration-platform market.

Growing Demand for Real-Time Data Integration

The hybrid integration platform market in Mexico is experiencing a surge in demand for real-time data integration solutions. Businesses are increasingly recognizing the necessity of accessing and processing data in real-time to enhance decision-making and operational efficiency. This trend is driven by the need for timely insights in various sectors, including finance and retail. According to recent estimates, the market for real-time data integration solutions is projected to grow at a CAGR of approximately 15% over the next five years. As organizations strive to remain competitive, the hybrid integration-platform market is likely to benefit from this growing demand, as companies seek to integrate disparate data sources seamlessly.

Expansion of Digital Transformation Initiatives

In Mexico, the ongoing digital transformation initiatives across various industries are significantly influencing the hybrid integration-platform market. Organizations are increasingly investing in technologies that facilitate the integration of legacy systems with modern applications. This shift is essential for improving operational efficiency and enhancing customer experiences. Reports indicate that nearly 70% of Mexican companies are prioritizing digital transformation, which is expected to drive the hybrid integration-platform market's growth. As businesses adopt new technologies, the need for robust integration solutions becomes paramount, thereby creating opportunities for vendors in the hybrid integration-platform market.

Adoption of Artificial Intelligence and Automation

The integration of artificial intelligence (AI) and automation technologies is emerging as a key driver for the hybrid integration-platform market in Mexico. Organizations are increasingly leveraging AI to enhance their integration processes, enabling smarter decision-making and improved operational efficiency. The adoption of automation tools is also facilitating the seamless integration of various applications and data sources. As businesses recognize the potential of AI and automation, the hybrid integration-platform market is expected to experience substantial growth. Analysts suggest that this trend could lead to a market expansion of approximately 10% over the next few years, as companies seek to optimize their integration strategies.