Rising Demand for Natural Gas

The directional drilling market in Mexico is witnessing a rising demand for natural gas, which is reshaping the energy landscape. As the country aims to transition towards cleaner energy sources, natural gas is becoming a preferred option due to its lower emissions compared to coal and oil. In 2025, natural gas consumption is expected to increase by 20%, prompting energy companies to invest in directional drilling technologies that facilitate efficient extraction. This shift not only supports the country's energy goals but also enhances the market for directional drilling services. The industry's ability to adapt to changing energy demands indicates a promising outlook, as companies leverage advanced drilling techniques to tap into natural gas reserves effectively.

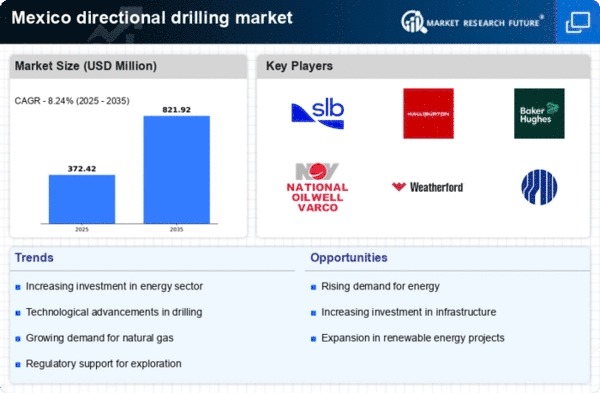

Increased Oil and Gas Exploration

The directional drilling market in Mexico is experiencing a surge due to increased oil and gas exploration activities. The government has been actively promoting exploration in untapped regions, which has led to a rise in demand for advanced drilling techniques. In 2025, the exploration budget allocated by the Mexican government is estimated to reach $2 billion, reflecting a 15% increase from the previous year. This investment is likely to enhance the capabilities of the directional drilling market, as companies seek to optimize resource extraction while minimizing environmental impact. The focus on deeper and more complex reservoirs necessitates the use of directional drilling technologies, which can navigate challenging geological formations. As a result, the industry is poised for growth, driven by the need for efficient and effective drilling solutions.

Infrastructure Development Initiatives

Infrastructure development initiatives in Mexico are significantly impacting the directional drilling market. The government has launched several projects aimed at improving transportation and energy infrastructure, which in turn drives the demand for directional drilling services. For instance, the construction of new pipelines and refineries requires precise drilling techniques to ensure safety and efficiency. In 2025, it is projected that infrastructure investments will exceed $10 billion, with a substantial portion allocated to energy projects. This influx of capital is likely to create opportunities for directional drilling companies to expand their operations and enhance their service offerings. The alignment of infrastructure development with energy needs suggests a robust growth trajectory for the directional drilling market, as companies adapt to meet the evolving demands of the sector.

Technological Innovations in Drilling Equipment

Technological innovations in drilling equipment are playing a crucial role in the directional drilling market. The introduction of advanced tools and techniques, such as rotary steerable systems and real-time data analytics, is enhancing drilling efficiency and accuracy. In Mexico, companies are increasingly adopting these innovations to reduce operational costs and improve safety standards. The market for drilling equipment is projected to grow by 12% annually, driven by the need for more sophisticated solutions. As the industry evolves, the integration of cutting-edge technologies is likely to redefine operational practices, making directional drilling more effective and reliable. This trend suggests that the directional drilling market will continue to expand as companies invest in modernizing their equipment and processes.

Government Policies Favoring Energy Sector Growth

Government policies favoring energy sector growth are significantly influencing the directional drilling market in Mexico. Recent reforms aimed at attracting foreign investment and enhancing competition have created a more favorable environment for drilling companies. In 2025, it is anticipated that regulatory changes will lead to a 25% increase in new drilling permits issued, facilitating greater exploration and production activities. These policies not only stimulate market growth but also encourage the adoption of innovative drilling techniques. The alignment of government objectives with industry needs suggests a robust future for the directional drilling market, as companies capitalize on the opportunities presented by a supportive regulatory framework.