Rising Cybersecurity Awareness

The Mexico Cloud Application Security Market is witnessing a notable increase in cybersecurity awareness among organizations. As cyber threats become more sophisticated, businesses are recognizing the importance of safeguarding their cloud applications. This awareness is prompting companies to prioritize security measures, leading to a projected market growth of around 12% annually. Educational initiatives and government campaigns are further enhancing understanding of cybersecurity risks, encouraging organizations to adopt comprehensive security frameworks. Consequently, the demand for cloud application security solutions is expected to rise, as businesses strive to protect their digital assets and maintain customer trust in the Mexico Cloud Application Security Market.

Increased Regulatory Compliance

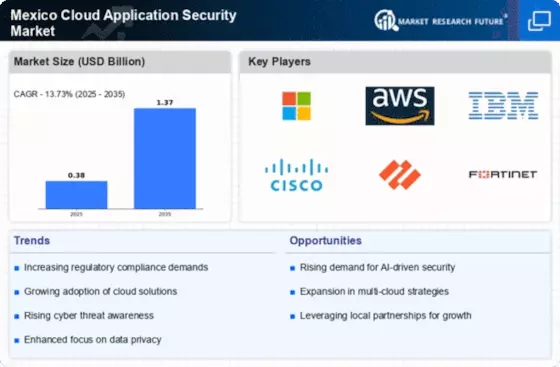

The Mexico Cloud Application Security Market is experiencing a surge in demand due to heightened regulatory compliance requirements. The government has implemented stringent data protection laws, such as the Federal Law on Protection of Personal Data Held by Private Parties, which mandates organizations to secure sensitive information. This regulatory landscape compels businesses to invest in cloud application security solutions to avoid hefty fines and reputational damage. As a result, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 15% over the next five years. Companies are increasingly seeking compliance-driven security solutions, which is likely to drive innovation and investment in the Mexico Cloud Application Security Market.

Growing Demand for Remote Work Solutions

The Mexico Cloud Application Security Market is experiencing a growing demand for remote work solutions, which has been accelerated by the shift towards flexible work arrangements. As organizations adopt cloud-based applications to facilitate remote collaboration, the need for robust security measures becomes paramount. This trend is expected to drive market growth by approximately 14% annually, as companies seek to protect sensitive data accessed from various locations. The emphasis on securing remote work environments is prompting investments in cloud application security solutions, thereby shaping the future landscape of the Mexico Cloud Application Security Market.

Adoption of Advanced Security Technologies

The Mexico Cloud Application Security Market is characterized by the rapid adoption of advanced security technologies. Organizations are increasingly leveraging artificial intelligence (AI) and machine learning (ML) to enhance their security posture. These technologies enable real-time threat detection and response, which is crucial in the face of evolving cyber threats. The market is anticipated to grow by approximately 18% over the next few years, driven by the need for innovative security solutions. As businesses seek to stay ahead of potential threats, the integration of AI and ML into cloud application security strategies is likely to become a standard practice within the Mexico Cloud Application Security Market.

Increased Investment in Digital Transformation

The Mexico Cloud Application Security Market is benefiting from increased investment in digital transformation initiatives. As businesses strive to enhance operational efficiency and customer engagement, they are migrating to cloud-based platforms. This transition necessitates a focus on security, as the risk of data breaches escalates. The market is projected to grow at a CAGR of around 16% as organizations allocate resources to secure their cloud applications. The emphasis on digital transformation is driving demand for comprehensive security solutions, which is likely to reshape the Mexico Cloud Application Security Market in the coming years.