Top Industry Leaders in the Methylene Diphenyl Diisocyanate Market

Methylene Diphenyl Diisocyanate (MDI), a crucial component in polyurethane (PU) production, finds its way into various applications, from construction insulation to car parts. driven by factors like rising demand for PU insulation in construction and the burgeoning automotive industry. This growth, however, unfolds in a competitive landscape marked by established players, regional variations, and evolving technological advancements.

Methylene Diphenyl Diisocyanate (MDI), a crucial component in polyurethane (PU) production, finds its way into various applications, from construction insulation to car parts. driven by factors like rising demand for PU insulation in construction and the burgeoning automotive industry. This growth, however, unfolds in a competitive landscape marked by established players, regional variations, and evolving technological advancements.

Strategies Shaping Market Share:

-

Product Diversification: Major players like BASF, Dow Chemical, and Covestro are expanding their portfolios beyond conventional MDI to offerspecialty MDI grades for specific applications. This caters to niche market demands and strengthens brand recognition. -

Capacity Expansion and Geographical Reach: Leading companies are strategically investing in production facilities across regions, particularly in Asia-Pacific, where the market is booming. This ensures supply chain resilience and access to high-growth markets. -

Sustainability Focus: Environmental concerns surrounding MDI production are prompting companies to adopt greener technologies. Phosgene-free MDI production processes and bio-based MDI alternatives are gaining traction, attracting environmentally conscious customers. -

Vertical Integration: Some players are integrating backward to secure raw material supply and control costs. Others are venturing into downstream PU product manufacturing, creating synergies and capturing greater market share. -

Digitalization and Innovation: Embracing digital tools for production optimization, supply chain management, and customer service is becoming crucial. Additionally, R&D efforts towards improved MDI performance and application discovery are ongoing.

Factors Influencing Market Share:

-

Production Cost and Capacity Utilization: Efficient production processes, access to low-cost raw materials, and optimal capacity utilization play a significant role in cost competitiveness and market share acquisition. -

Brand Reputation and Customer Relationships: Established brands with strong track records and deep customer relationships hold an advantage in securing orders and maintaining market presence. -

Regional Demand Dynamics: Asia-Pacific, with its rapid urbanization and growing construction and automotive sectors, is a key battleground for market share. However, regional regulations and trade policies can impact market dynamics. -

Environmental and Safety Regulations: Stringent regulations regarding MDI production and handling can favor players with advanced safety protocols and environmentally friendly processes. -

Technological Advancements: Development of new MDI production technologies, bio-based alternatives, and improved PU applications can create opportunities for market differentiation and growth.

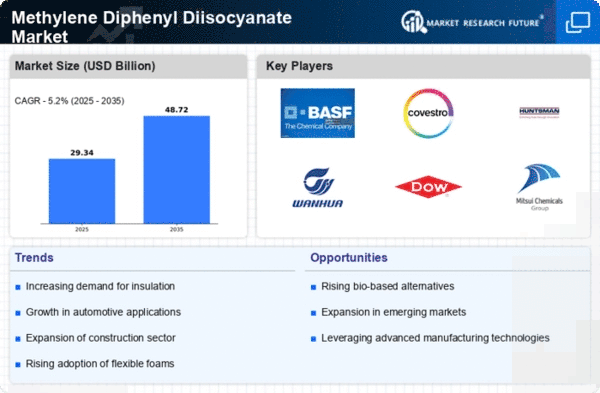

Key Players

- Tosoh Corporation (Million)

- Hexion (US)

- Huntsman International LLC (Rubinate)

- BASF SE (Germany)

- Redox Pty Ltd (Australia)

- Wanhua Chemical Group Co.

- TCI Chemicals Pvt Ltd (India)

- Merck KGaA (Germany)

- KUMHO MITSUI CHEMICAL CORP (South Korea)

- DHAL OP CHEMICAL (India)

- DOW (Isonate) US

Recent Developments:

August 2023: Huntsman Corporation acquires a leading bio-based MDI producer, signaling its commitment to sustainable MDI alternatives and potentially disrupting the market with its expanded product portfolio.

September 2023: The Indian government announces plans to invest in domestic MDI production, potentially reducing reliance on imports and creating a new market player in the region.

October 2023: Covestro and Mitsubishi Chemical Corporation form a joint venture to develop and commercialize next-generation MDI catalysts, aiming to improve production efficiency and reduce costs.

November 2023: The US Environmental Protection Agency proposes stricter regulations on MDI waste disposal, impacting production facilities and potentially increasing compliance costs for American MDI producers.