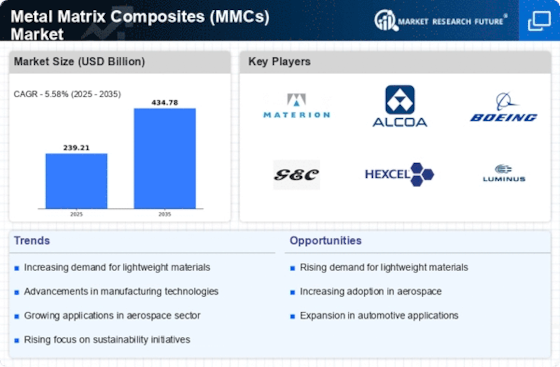

Top Industry Leaders in the Metal Matrix Composites MMCs Market

The Metal Matrix Composites (MMCs) market is driven by the relentless pursuit of lightweighting in various industries like automotive, aerospace, and defense, where MMCs offer a unique blend of high strength, corrosion resistance, and thermal conductivity. The market, however, remains fragmented with strong regional variations and intense competition among established players and emerging start-ups.

Metal Matrix Composites MMCs Market Strategies for Market Share:

-

Product innovation: Companies like Toray Industries (Japan) and Alcoa Inc. (US) are heavily investing in R&D to develop new MMCs with superior properties and cost-effectiveness. This includes exploring alternative matrix materials, reinforcement fibers, and fabrication techniques. -

Vertical integration: Leading players like Umeco Plc (UK) and Hexcel Composites (France) are integrating upstream into raw material extraction and downstream into component manufacturing. This secures supply chains, optimizes production processes, and offers complete solutions to customers. -

Strategic partnerships: Collaborations between research institutions, universities, and industry players are fostering knowledge sharing and accelerating technology development. Partnerships with aircraft and automotive manufacturers provide valuable market insights and early access to application opportunities. -

Regional expansion: Established players like Lanxess AG (Germany) and Morgan Advanced Materials (UK) are expanding their footprints into high-growth regions like Asia Pacific, particularly China and India. This involves setting up production facilities, establishing local partnerships, and tailoring product offerings to regional needs.

Factors Influencing Market Share:

-

Market application: Automotive and aerospace industries currently dominate the MMCs market, but their growth rates vary. The automotive industry focuses on cost-competitive solutions for mass production, while aerospace prioritizes high-performance options. Companies catering to specific application needs gain an edge. -

Government regulations: Stringent fuel efficiency and emission regulations in developed economies are driving demand for lightweight MMCs in the automotive sector. Government support for research and development also influences market dynamics. -

Raw material costs: Prices of key raw materials like aluminum and ceramic fibers can significantly impact production costs. Companies with efficient sourcing strategies and alternative material development have an advantage. -

Technological advancements: Advancements in fabrication techniques like additive manufacturing offer opportunities for near-net-shape MMCs, reducing waste and production time. Companies at the forefront of such innovations gain a competitive edge.

Key Companies in the Metal Matrix Composites (MMCs) market include

- A Materion Corporation (US)

- CPS Technologies Corporation (US)

- GKN Sinter Metals (US)

- 3M (US)

- DestsceEdelstaslwerke GmbH (Germany)

- Metal Matrix Cast Composites

- LLC (US)

- Plansee SE (Austria)

- Ceram Tec (Germany)

- Sandvik AB (Sweden)

- Ferrotec Corporation (US)

Recent News

Hyperion Materials & Technologies, a leading manufacturer of hard and super-hard materials for various demanding industrial applications, in November 2023 unveiled two new polycrystalline diamond (PCD) lines called the P-Series and U-Series, broadening its offering for the toolmaking industry. P-Series PCD is specifically designed for use in nonferrous machining tools as well as non-metallic workpieces across automotive, aerospace, electronics, and other precision applications that require stable performance and long-term cost-savings. It has found fantastic performance across different workpieces such as aluminum, metal matrix composites, copper, carbon-fiber-reinforced polymers (CFRP), etc., in addition to precision applications.

On February 1st, Toray Advanced Composites of Nijverdal in The Netherlands announced the start of a lifecycle assessment (LCA) strategy targeted at its Toray Cetex thermoplastic composite materials range. This step is part of its environmental responsibility drive, which aims to measure down and minimize the environmental impact of its manufacturing processes. Initially, it concentrated on Toray Cetex materials manufactured at their site in Nijverdal, The Netherlands; however, there are plans to expand this scheme by including U.S. facilities plus their thermoset composite materials.