Market Trends

Key Emerging Trends in the Metabolic Biomarker Testing Market

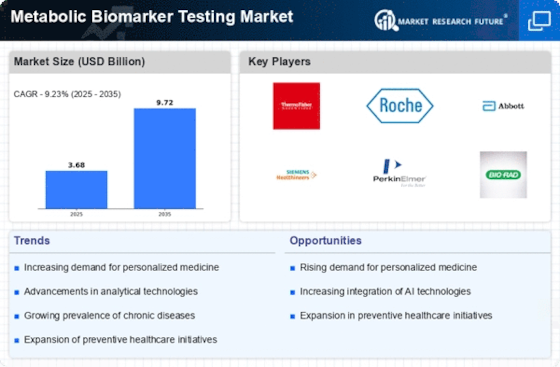

The metabolic biomarker testing market is witnessing growth driven by the increasing prevalence of metabolic disorders such as diabetes, obesity, and cardiovascular disease globally, highlighting the need for early detection and personalized management strategies. Technological advancements in biomarker discovery and validation techniques, including genomics, proteomics, metabolomics, and bioinformatics, are facilitating the identification of novel metabolic biomarkers associated with disease risk, progression, and treatment response.

There is a shift towards personalized medicine approaches in metabolic disorder management, leveraging metabolic biomarker testing to stratify patients based on their individual risk profiles, genetic predispositions, and metabolic phenotypes, leading to more targeted and effective interventions. The integration of AI and machine learning algorithms into metabolic biomarker testing platforms is enhancing data analysis, interpretation, and predictive modeling capabilities, enabling more accurate risk assessment, diagnosis, and prognosis of metabolic disorders.

The adoption of point-of-care metabolic biomarker testing devices, such as handheld analyzers and wearable sensors, is increasing, allowing for rapid and convenient testing in clinical settings, pharmacies, and community health centers, improving access to metabolic health screening and monitoring. There is growing emphasis on early detection and prevention of metabolic disorders through routine biomarker screening, lifestyle interventions, and targeted interventions aimed at addressing modifiable risk factors such as diet, physical activity, and smoking. Companion diagnostic testing for metabolic disorders, including biomarker-based companion diagnostics for pharmacogenomics and targeted therapy selection, is expanding, driving collaboration between diagnostic companies, pharmaceutical manufacturers, and healthcare providers. The identification of novel biomarkers for non-alcoholic fatty liver disease (NAFLD), a common metabolic disorder associated with obesity and insulin resistance, is driving research and development efforts in the metabolic biomarker testing market. Regulatory compliance and quality assurance are critical in the metabolic biomarker testing market, with manufacturers investing in clinical validation studies, analytical performance evaluations, and regulatory approvals to ensure the accuracy, reliability, and safety of biomarker testing assays. Reimbursement policies and guidelines for metabolic biomarker testing vary by region and healthcare system, impacting market adoption and accessibility of biomarker testing services for patients with metabolic disorders.

The integration of metabolic biomarker testing results into electronic health records (EHRs) and health information systems is improving care coordination, clinical decision-making, and population health management for patients with metabolic disorders. The metabolic biomarker testing market is experiencing global expansion, with emerging markets in regions such as Asia-Pacific, Latin America, and the Middle East presenting untapped opportunities for market growth due to increasing healthcare expenditure, expanding healthcare infrastructure, and rising prevalence of metabolic disorders. Patient education and empowerment initiatives focusing on metabolic health literacy, self-monitoring of biomarkers, and lifestyle modifications are driving demand for metabolic biomarker testing services and fostering patient engagement in disease management. Collaborative research initiatives between academia, industry, and government organizations are driving innovation and advancement in metabolic biomarker discovery, validation, and clinical translation, leading to the development of new diagnostic tools and therapeutic targets for metabolic disorders. Public health campaigns aimed at raising awareness of metabolic disorders, promoting healthy lifestyle behaviors, and advocating for early detection and intervention strategies are driving demand for metabolic biomarker testing services and shaping market trends in the metabolic health sector.

Leave a Comment