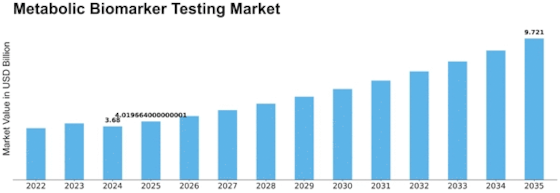

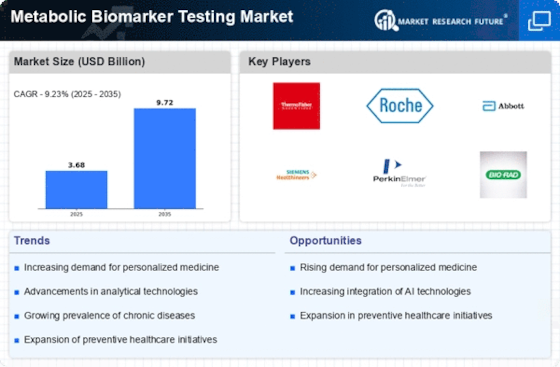

Metabolic Biomarker Testing Size

Metabolic Biomarker Testing Market Growth Projections and Opportunities

The increasing global prevalence of metabolic disorders such as diabetes, obesity, and cardiovascular diseases is a significant driver of the metabolic biomarker testing market. As these conditions become more prevalent, there is a growing need for early detection, monitoring, and management, fueling demand for biomarker testing to assess metabolic health and identify individuals at risk. With the aging population, there is a higher incidence of age-related metabolic changes and chronic diseases. As individuals age, their metabolism may slow down, increasing the risk of metabolic disorders such as diabetes and cardiovascular diseases. The growing elderly population contributes to the demand for metabolic biomarker testing to assess and manage metabolic health in older adults. Advances in technology have led to the development of more accurate, sensitive, and efficient biomarker testing methods. Innovations in analytical techniques, such as mass spectrometry, immunoassays, and molecular diagnostics, have improved the detection and quantification of metabolic biomarkers, driving market growth by enhancing testing accuracy and reliability. The shift towards precision medicine approaches in healthcare, which emphasize personalized diagnosis and treatment based on individual genetic, environmental, and lifestyle factors, is driving demand for metabolic biomarker testing. Biomarker profiling allows for tailored interventions and targeted therapies, influencing market growth and adoption of personalized healthcare solutions.

The global obesity epidemic is a major contributor to the rising prevalence of metabolic disorders such as type 2 diabetes, hypertension, and dyslipidemia. As obesity rates continue to rise worldwide, there is a growing need for metabolic biomarker testing to assess metabolic health, guide lifestyle interventions, and monitor disease progression, driving market demand. The availability and accessibility of healthcare infrastructure, including hospitals, clinics, and diagnostic laboratories, impact the adoption and utilization of metabolic biomarker testing. Access to testing facilities and expertise in biomarker analysis influence market dynamics and the delivery of metabolic healthcare services. Stringent regulations govern the development, validation, and commercialization of biomarker tests for clinical use. Compliance with regulatory requirements ensures the safety, efficacy, and quality of biomarker testing products, influencing market dynamics and consumer confidence in testing technologies. Reimbursement policies and coverage for metabolic biomarker testing by government healthcare programs and private insurance companies impact patient access to testing services and affordability. Reimbursement decisions influence market demand for biomarker testing and reimbursement strategies of diagnostic companies. Ongoing research into metabolic biomarkers and their association with disease risk, progression, and treatment response drives innovation and product development within the market. Investments in biomarker discovery, validation, and clinical utility studies lead to the introduction of new biomarker tests and technologies, shaping market trends and adoption rates.

Patient education initiatives aimed at raising awareness about the importance of metabolic health, risk factors for metabolic disorders, and the role of biomarker testing in disease prevention and management play a crucial role in driving market growth. Educating patients empowers them to seek appropriate testing and interventions to improve metabolic health. Collaboration between healthcare providers, researchers, and diagnostic companies fosters interdisciplinary approaches to metabolic health assessment and management. Multidisciplinary care teams influence market dynamics by promoting biomarker testing utilization and facilitating the integration of metabolic testing into clinical practice. Economic factors such as GDP growth, healthcare spending, and healthcare infrastructure investments impact market dynamics and growth opportunities for metabolic biomarker testing. Economic conditions influence market demand, pricing strategies, and investment decisions of diagnostic companies operating in different regions. The integration of biomarker testing into routine clinical practice guidelines and healthcare protocols drives market growth by promoting standardized testing algorithms and increasing testing utilization. Biomarker testing becomes an integral part of metabolic health assessment and disease management strategies, influencing market adoption rates. The expansion of healthcare infrastructure and increasing awareness of metabolic health issues in emerging markets present growth opportunities for metabolic biomarker testing. Penetrating emerging markets drives market expansion and increases market share for diagnostic companies offering biomarker testing solutions. The COVID-19 pandemic has accelerated trends towards remote healthcare delivery, telemedicine, and digital health solutions. Adapting to new challenges and implementing virtual biomarker testing platforms and remote monitoring solutions have become crucial strategies for maintaining continuity of care and addressing patient needs amidst the pandemic, influencing market dynamics and adoption of innovative testing technologies.

Leave a Comment