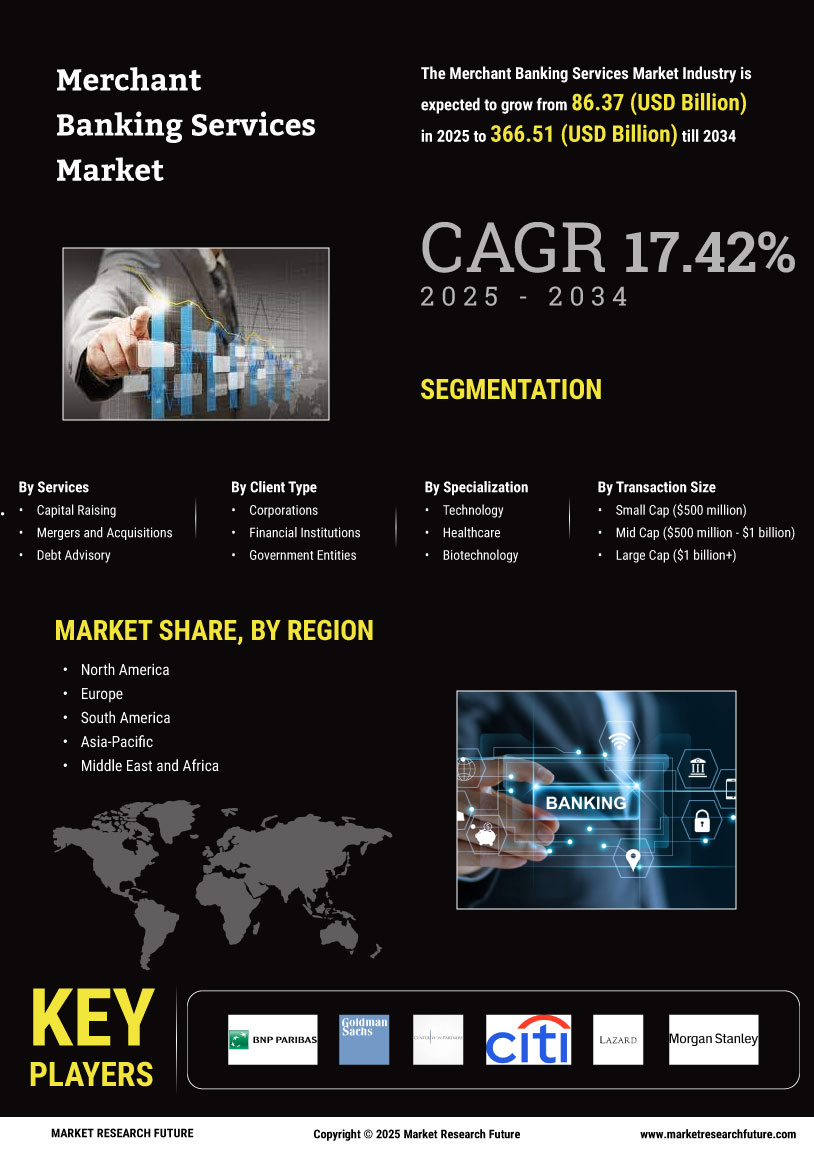

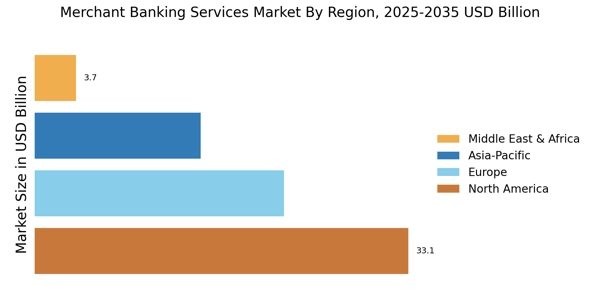

Expansion of Emerging Markets

The Merchant Banking Services Market is witnessing significant expansion in emerging markets, where economic growth is robust. Countries in Asia and Africa are experiencing rapid industrialization and urbanization, leading to increased investment opportunities. This expansion is reflected in the rising number of transactions and capital flows within these regions. For instance, the merchant banking sector in Asia has reported a surge in deal activity, with a year-on-year increase of 15% in cross-border transactions. This trend suggests that merchant banks are increasingly focusing on these markets to capitalize on growth potential. As a result, the Merchant Banking Services Market is likely to see enhanced service offerings tailored to the unique needs of these emerging economies.

Increased Demand for Advisory Services

The Merchant Banking Services Market is experiencing a notable increase in demand for advisory services. This trend is driven by businesses seeking expert guidance on mergers, acquisitions, and capital raising. As companies navigate complex financial landscapes, the need for specialized advisory services becomes paramount. According to recent data, the advisory segment within the merchant banking sector has seen a growth rate of approximately 8% annually. This growth is indicative of a broader trend where firms prioritize strategic financial planning and risk management. The Merchant Banking Services Market is thus positioned to benefit from this heightened demand, as financial institutions enhance their advisory capabilities to meet client expectations.

Regulatory Changes and Compliance Needs

The Merchant Banking Services Market is significantly influenced by evolving regulatory frameworks that necessitate compliance. Financial institutions are increasingly required to adhere to stringent regulations aimed at ensuring transparency and accountability. This has led to a rise in demand for compliance-related services within the merchant banking sector. Recent data suggests that compliance expenditures have increased by approximately 10% over the past year, as firms invest in systems and processes to meet regulatory requirements. Consequently, the Merchant Banking Services Market is adapting by enhancing its compliance offerings, thereby providing clients with the necessary tools to navigate complex regulatory environments.

Growing Interest in Sustainable Investments

The Merchant Banking Services Market is experiencing a growing interest in sustainable investments, as investors increasingly prioritize environmental, social, and governance (ESG) factors. This shift is prompting merchant banks to develop and promote investment products that align with sustainability goals. Recent surveys indicate that nearly 70% of institutional investors are now considering ESG criteria in their investment decisions. This trend not only reflects changing investor preferences but also presents an opportunity for the Merchant Banking Services Market to innovate and offer tailored solutions that meet the demand for responsible investing. As a result, merchant banks are likely to enhance their focus on sustainable finance initiatives.

Technological Advancements in Financial Services

Technological advancements are reshaping the Merchant Banking Services Market, as financial institutions adopt innovative solutions to enhance service delivery. The integration of artificial intelligence, blockchain, and data analytics is streamlining operations and improving client experiences. For example, the use of AI in risk assessment and credit analysis has become prevalent, allowing banks to make more informed decisions. Recent studies indicate that firms leveraging technology in their operations have reported a 20% increase in efficiency. This technological shift not only enhances operational capabilities but also positions the Merchant Banking Services Market to attract tech-savvy clients seeking modern financial solutions.