Medical Suction Device Size

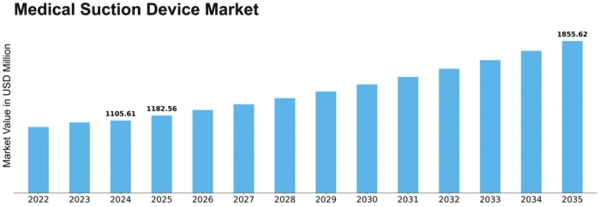

Medical Suction Device Market Growth Projections and Opportunities

The market factors influencing the medical suction devices market are multifaceted and pivotal for the industry's growth and dynamics. Firstly, the increasing prevalence of chronic respiratory diseases and surgical procedures worldwide drives the demand for medical suction devices. Conditions like chronic obstructive pulmonary disease (COPD), pneumonia, and bronchitis necessitate effective airway clearance, which medical suction devices provide, thus fostering market expansion. Moreover, the rising geriatric population prone to respiratory ailments contributes significantly to market growth, as elderly individuals often require respiratory support and suctioning procedures.

Secondly, advancements in technology play a crucial role in shaping the medical suction devices market landscape. Innovations such as portable suction units, battery-operated devices, and improved suction catheters enhance the efficiency, portability, and ease of use of these devices. Healthcare facilities increasingly adopt advanced suction devices to streamline patient care, reduce procedural time, and minimize the risk of infections, thereby propelling market growth.

Furthermore, stringent regulatory guidelines and standards set by healthcare authorities significantly influence the medical suction devices market. Compliance with regulatory requirements ensures the safety, efficacy, and quality of suction devices, instilling confidence among healthcare providers and end-users. Manufacturers invest in research and development to develop compliant products and adhere to regulatory protocols, which impacts product pricing, market entry, and competitive dynamics.

The economic landscape and healthcare expenditure patterns also shape the medical suction devices market. Increasing healthcare expenditure, particularly in emerging economies, facilitates infrastructure development, healthcare reforms, and the procurement of medical equipment, including suction devices. Government initiatives, insurance coverage, and reimbursement policies further influence the adoption and accessibility of medical suction devices, driving market expansion.

Moreover, the COVID-19 pandemic has underscored the importance of medical suction devices in managing respiratory complications and aerosol-generating procedures. The surge in hospital admissions, intensive care unit (ICU) admissions, and respiratory interventions during the pandemic has escalated the demand for suction devices and respiratory care equipment. Healthcare facilities prioritize the procurement of suction devices to support respiratory therapy, airway management, and infection control protocols, stimulating market growth amidst the global health crisis.

Additionally, market dynamics such as competitive rivalry, industry consolidation, and strategic partnerships shape the competitive landscape of the medical suction devices market. Market players engage in mergers, acquisitions, and collaborations to expand their product portfolios, geographical presence, and technological capabilities. Product differentiation, pricing strategies, and after-sales services also influence consumer preferences and market share, driving innovation and market competitiveness.

Furthermore, increasing awareness about the importance of airway management, infection prevention, and patient safety fosters the adoption of medical suction devices across healthcare settings. Educational initiatives, training programs, and clinical guidelines emphasize the proper use of suction devices, infection control measures, and patient care protocols, enhancing market penetration and end-user acceptance.

Leave a Comment