Increasing Healthcare Expenditure

The Medical Non-Woven Disposable Market is benefiting from rising healthcare expenditure across multiple regions. Governments and private sectors are investing heavily in healthcare infrastructure, which includes the procurement of disposable medical products. According to recent data, healthcare spending is projected to reach unprecedented levels, with an estimated increase of 8% annually in many regions. This surge in investment is likely to drive the demand for non-woven disposables, as healthcare facilities seek to enhance their operational efficiency and patient care standards. The emphasis on cost-effective and efficient medical supplies further supports the growth of the non-woven disposable segment.

Rising Demand for Infection Control Products

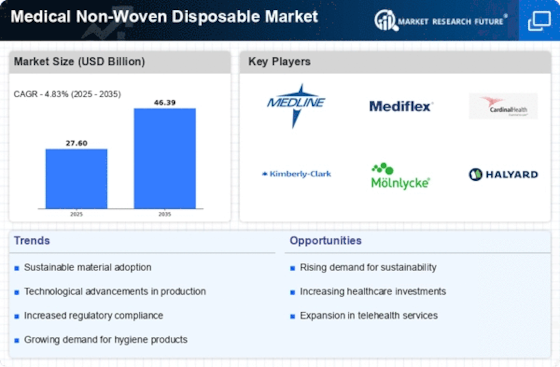

The Medical Non-Woven Disposable Market is experiencing a notable increase in demand for infection control products. This trend is driven by heightened awareness of hygiene and safety protocols across various sectors, including healthcare, food processing, and pharmaceuticals. The market for disposable medical products is projected to grow at a compound annual growth rate (CAGR) of approximately 6.5% over the next few years. This growth is indicative of a broader shift towards preventive healthcare measures, where non-woven disposables play a crucial role in minimizing the risk of cross-contamination and infection. As healthcare facilities prioritize patient safety, the adoption of non-woven disposable products is likely to expand, further solidifying their position in the market.

Technological Innovations in Material Science

Innovations in material science are significantly influencing the Medical Non-Woven Disposable Market. The development of advanced non-woven fabrics, which offer enhanced barrier properties and breathability, is reshaping product offerings. For instance, the introduction of hydrophobic and hydrophilic non-woven materials has improved the functionality of disposable medical products, making them more effective in various applications. The market is expected to witness a surge in the adoption of these innovative materials, as they provide better protection against pathogens while ensuring comfort for users. This technological advancement not only enhances product performance but also aligns with the growing demand for high-quality disposable medical supplies.

Growing Awareness of Environmental Sustainability

The Medical Non-Woven Disposable Market is increasingly influenced by the growing awareness of environmental sustainability. As consumers and healthcare providers become more conscious of their ecological footprint, there is a rising demand for eco-friendly disposable products. Manufacturers are responding by developing biodegradable and recyclable non-woven materials, which align with sustainability goals. This shift not only addresses environmental concerns but also appeals to a market segment that prioritizes green practices. The integration of sustainable practices in the production of medical disposables is expected to enhance brand loyalty and market share for companies that adopt these initiatives.

Regulatory Support for Disposable Medical Products

The Medical Non-Woven Disposable Market is also shaped by regulatory support aimed at ensuring the safety and efficacy of disposable medical products. Regulatory bodies are establishing stringent guidelines that govern the manufacturing and distribution of non-woven disposables, which enhances consumer confidence in these products. Compliance with these regulations is crucial for market players, as it not only ensures product safety but also facilitates market entry. The ongoing evolution of regulatory frameworks is likely to create a more structured environment for the Medical Non-Woven Disposable Market, fostering innovation and encouraging the development of high-quality products.

Leave a Comment