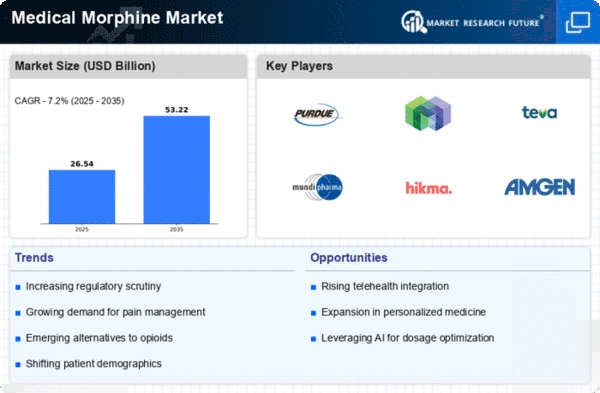

Market Growth Projections

The Global Medical Morphine Market Industry is projected to experience substantial growth over the next decade. With a market value expected to reach 24.8 USD Billion in 2024 and further expand to 53.2 USD Billion by 2035, the industry is poised for a remarkable trajectory. The compound annual growth rate of 7.2% from 2025 to 2035 indicates a robust demand for morphine as a critical component of pain management. This growth is influenced by various factors, including the rising prevalence of chronic pain conditions and increased regulatory support for opioid use. The market's expansion underscores the vital role of morphine in addressing global pain management needs.

Advancements in Drug Formulations

Innovations in drug formulations are playing a pivotal role in the Global Medical Morphine Market Industry. The development of extended-release and combination formulations enhances the therapeutic efficacy of morphine while minimizing side effects. These advancements are particularly beneficial for patients requiring long-term pain management. As a result, healthcare providers are more inclined to prescribe morphine, thereby driving market growth. The anticipated compound annual growth rate of 7.2% from 2025 to 2035 indicates a robust market trajectory, fueled by these innovations. Consequently, the Global Medical Morphine Market Industry is likely to witness a transformation in treatment approaches.

Regulatory Support for Opioid Use

Regulatory frameworks across various countries are evolving to support the use of opioids, including morphine, for pain management. Governments are increasingly recognizing the necessity of balancing pain relief with the risks of addiction. This regulatory support is crucial for the Global Medical Morphine Market Industry, as it fosters an environment where healthcare professionals can prescribe morphine more confidently. For instance, initiatives aimed at educating prescribers about safe opioid use are gaining traction. Such measures not only enhance patient care but also contribute to the anticipated growth of the market, projected to reach 53.2 USD Billion by 2035.

Growing Awareness of Pain Management Options

There is a growing awareness among healthcare professionals and patients regarding the importance of effective pain management. This awareness is driving the Global Medical Morphine Market Industry as more individuals seek appropriate treatment options for chronic pain. Educational campaigns and initiatives aimed at informing both patients and providers about the benefits of morphine are gaining momentum. As a result, the market is likely to expand, with projections indicating a market value of 53.2 USD Billion by 2035. This increasing awareness not only enhances patient outcomes but also reinforces the necessity of morphine in contemporary pain management strategies.

Increasing Demand for Pain Management Solutions

The Global Medical Morphine Market Industry experiences a notable surge in demand for effective pain management solutions. As chronic pain conditions become more prevalent, healthcare providers increasingly turn to morphine as a reliable analgesic. This trend is underscored by the projected market value of 24.8 USD Billion in 2024, reflecting a growing recognition of morphine's efficacy in managing severe pain. Furthermore, the aging population, which is more susceptible to chronic pain, contributes to this demand. As a result, the Global Medical Morphine Market Industry is poised for substantial growth, driven by the need for effective pain relief options.

Rising Incidence of Cancer and Palliative Care Needs

The increasing incidence of cancer globally is significantly impacting the Global Medical Morphine Market Industry. Cancer patients often experience severe pain, necessitating effective pain management strategies. Morphine is widely recognized as a first-line treatment for cancer-related pain, making it indispensable in palliative care settings. As the global cancer burden rises, the demand for morphine is expected to escalate, further propelling market growth. This trend aligns with the projected market value of 24.8 USD Billion in 2024, highlighting the critical role of morphine in addressing the needs of patients requiring palliative care.