Expansion of Healthcare Infrastructure

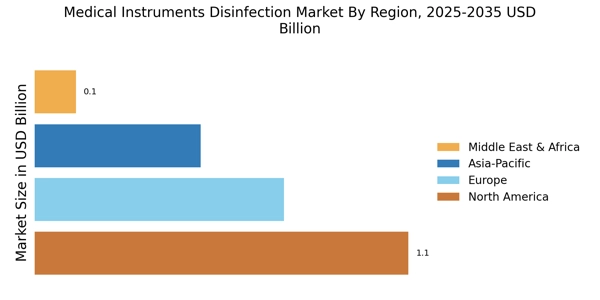

The expansion of healthcare infrastructure, particularly in emerging economies, is a crucial driver for the Medical Instruments Disinfection Market. As new hospitals and clinics are established, there is a corresponding need for effective disinfection solutions to ensure patient safety and compliance with health regulations. This trend is particularly evident in regions experiencing rapid urbanization and population growth, where healthcare facilities are being developed to meet increasing demand. The market is projected to grow at a rate of approximately 11% as these new facilities seek to implement state-of-the-art disinfection technologies. Consequently, manufacturers are focusing on providing scalable and efficient disinfection solutions tailored to the needs of expanding healthcare systems.

Increased Regulatory Standards and Compliance

The Medical Instruments Disinfection Market is significantly influenced by the stringent regulatory standards imposed by health authorities. Regulatory bodies are continuously updating guidelines to ensure the safety and efficacy of disinfection practices in healthcare settings. Compliance with these regulations is not only essential for patient safety but also for the operational integrity of healthcare facilities. As a result, there is a growing demand for disinfection products that meet these rigorous standards. The market is witnessing a shift towards products that are certified and validated by regulatory agencies, which is expected to drive growth. It is estimated that the market could see an increase of approximately 8% in value as healthcare providers invest in compliant disinfection solutions.

Growing Awareness of Infection Control Practices

The rising awareness of infection control practices among healthcare professionals and patients is a significant driver for the Medical Instruments Disinfection Market. Educational initiatives and training programs are emphasizing the importance of proper disinfection techniques to prevent the spread of infections. This heightened awareness is leading to increased investments in disinfection technologies and practices within healthcare facilities. As hospitals and clinics strive to enhance their infection control measures, the demand for effective disinfection solutions is likely to surge. Market analysts predict a growth trajectory of around 9% in the coming years, as healthcare providers prioritize the implementation of comprehensive disinfection protocols to safeguard patient health.

Technological Innovations in Disinfection Solutions

Technological advancements play a pivotal role in shaping the Medical Instruments Disinfection Market. Innovations such as automated disinfection systems, ultraviolet (UV) light technology, and advanced chemical agents are revolutionizing the way medical instruments are disinfected. These technologies not only enhance the efficacy of disinfection processes but also reduce the time and labor involved. For instance, UV disinfection systems have gained traction due to their ability to eliminate pathogens without the use of harmful chemicals. The market for these innovative solutions is expected to expand, with estimates suggesting a growth rate of around 12% annually. As healthcare facilities increasingly adopt these technologies, the demand for sophisticated disinfection solutions will likely continue to rise.

Rising Incidence of Healthcare-Associated Infections

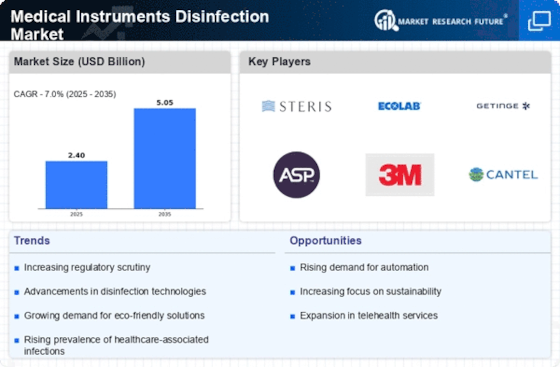

The increasing prevalence of healthcare-associated infections (HAIs) is a critical driver for the Medical Instruments Disinfection Market. According to data, HAIs affect millions of patients annually, leading to extended hospital stays and increased healthcare costs. This alarming trend has prompted healthcare facilities to prioritize stringent disinfection protocols for medical instruments. As a result, the demand for advanced disinfection solutions is expected to rise significantly. The market is projected to witness a compound annual growth rate (CAGR) of approximately 10% over the next few years, driven by the urgent need to mitigate infection risks and enhance patient safety. Consequently, manufacturers are innovating to provide effective disinfection technologies that meet the evolving needs of healthcare providers.