Emergence of Telemedicine

The Global Medical Imaging Workstations Market Industry is witnessing a shift due to the emergence of telemedicine, which is reshaping how healthcare services are delivered. Telemedicine enables remote consultations and diagnostics, increasing the demand for imaging workstations that support digital connectivity and remote access to imaging data. This trend is particularly relevant in rural and underserved areas, where access to healthcare services may be limited. As telemedicine continues to grow, the market for imaging workstations is expected to expand, driven by the need for efficient and accessible diagnostic solutions. This evolution in healthcare delivery models indicates a promising future for the industry.

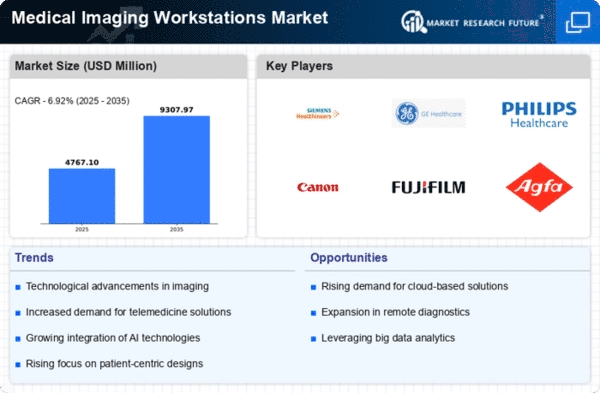

Market Growth Projections

The Global Medical Imaging Workstations Market Industry is projected to experience substantial growth in the coming years. With a market value expected to reach 6 USD Billion by 2035, the industry is poised for significant expansion. The anticipated compound annual growth rate of 4.89% from 2025 to 2035 highlights the increasing demand for advanced imaging technologies. This growth is likely to be fueled by factors such as technological advancements, rising chronic disease prevalence, and an aging population. As healthcare providers continue to invest in innovative imaging solutions, the market is expected to evolve, reflecting the changing landscape of medical diagnostics.

Technological Advancements

The Global Medical Imaging Workstations Market Industry is experiencing rapid technological advancements, particularly in imaging modalities such as MRI, CT, and ultrasound. These innovations enhance image quality and diagnostic accuracy, which are crucial for effective patient care. For instance, the integration of artificial intelligence in imaging workstations allows for improved image analysis and faster diagnosis. As a result, the market is projected to reach 3.55 USD Billion in 2024, reflecting the growing demand for advanced imaging solutions. This trend suggests that healthcare providers are increasingly investing in state-of-the-art imaging technologies to improve patient outcomes.

Growing Geriatric Population

The Global Medical Imaging Workstations Market Industry is significantly influenced by the growing geriatric population, which is more susceptible to various health issues requiring imaging services. As the global population ages, the demand for diagnostic imaging is expected to rise, leading to an increased need for advanced imaging workstations. This demographic shift is likely to drive market growth, as healthcare providers invest in technologies that cater to the unique needs of older patients. The anticipated compound annual growth rate of 4.89% from 2025 to 2035 further underscores the potential for expansion in this sector, as facilities adapt to meet the demands of an aging population.

Increased Healthcare Expenditure

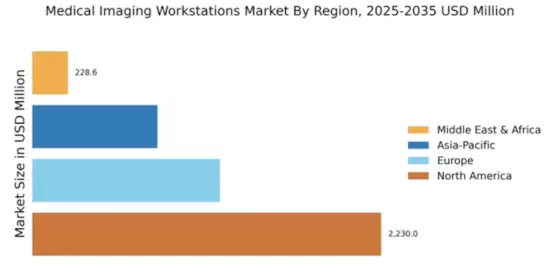

The Global Medical Imaging Workstations Market Industry is benefiting from increased healthcare expenditure across various regions. Governments and private sectors are allocating more resources to healthcare infrastructure, which includes the acquisition of advanced imaging technologies. This trend is particularly evident in developing countries, where investments in healthcare are expanding rapidly. As a result, the market is poised for growth, with a projected value of 3.55 USD Billion in 2024. Enhanced funding for healthcare initiatives is likely to facilitate the adoption of cutting-edge imaging workstations, ultimately improving diagnostic capabilities and patient care.

Rising Incidence of Chronic Diseases

The Global Medical Imaging Workstations Market Industry is driven by the rising incidence of chronic diseases, which necessitates advanced diagnostic imaging solutions. Conditions such as cardiovascular diseases, cancer, and neurological disorders require precise imaging for effective treatment planning. The increasing prevalence of these diseases is prompting healthcare facilities to upgrade their imaging capabilities. This trend is expected to contribute to the market's growth, with projections indicating a rise to 6 USD Billion by 2035. Consequently, the demand for sophisticated imaging workstations is likely to increase, as healthcare providers seek to enhance their diagnostic accuracy and treatment efficacy.