Aging Population

The demographic shift towards an aging population in the US is a crucial driver for the medical imaging-workstations market. As individuals age, the prevalence of chronic diseases and conditions requiring imaging services increases. By 2030, it is estimated that 20% of the US population will be 65 years or older, leading to a heightened demand for diagnostic imaging. This demographic trend compels healthcare providers to invest in modern imaging workstations that can handle the increased volume of imaging studies. Moreover, the aging population often requires more frequent monitoring and follow-up imaging, which further stimulates the medical imaging-workstations market. The need for efficient and reliable imaging solutions is paramount, as healthcare systems strive to meet the demands of this growing patient demographic.

Rising Healthcare Expenditure

The medical imaging-workstations market is growing due to the increasing healthcare expenditure in the US.. As healthcare budgets expand, hospitals and clinics are investing more in advanced imaging technologies. In 2025, healthcare spending is projected to reach approximately $4.5 trillion, which represents a significant increase from previous years. This financial commitment allows healthcare facilities to upgrade their imaging workstations, enhancing diagnostic capabilities and improving patient outcomes. Furthermore, the shift towards value-based care is prompting healthcare providers to adopt more sophisticated imaging solutions, thereby driving demand in the medical imaging-workstations market. The integration of high-resolution displays and advanced software in these workstations is becoming essential for accurate diagnostics, which is likely to further propel market growth.

Technological Advancements in Imaging

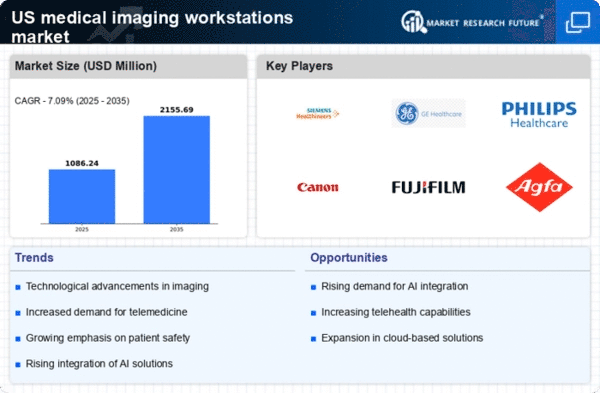

Technological advancements in imaging modalities are significantly influencing the medical imaging-workstations market. Innovations such as artificial intelligence (AI) and machine learning are being integrated into imaging workstations, enhancing diagnostic accuracy and workflow efficiency. In 2025, the market for AI in medical imaging is expected to reach $2 billion, indicating a robust growth trajectory. These advancements not only improve the quality of images but also streamline the interpretation process, allowing radiologists to make quicker and more informed decisions. As healthcare providers seek to adopt cutting-edge technologies to remain competitive, the demand for advanced medical imaging workstations is likely to increase. This trend underscores the importance of continuous innovation in the medical imaging-workstations market.

Growing Focus on Preventive Healthcare

The growing focus on preventive healthcare is driving demand in the medical imaging-workstations market. As healthcare systems shift towards preventive measures, the need for early detection of diseases becomes paramount. Imaging workstations play a critical role in facilitating routine screenings and diagnostic imaging, which are essential for identifying health issues at an early stage. In 2025, the preventive healthcare market is projected to reach $1 trillion, reflecting a significant investment in health promotion and disease prevention. This trend encourages healthcare providers to enhance their imaging capabilities, leading to increased purchases of advanced workstations. Consequently, the medical imaging-workstations market is likely to see sustained growth as providers prioritize preventive care strategies.

Regulatory Support for Imaging Technologies

Regulatory support for imaging technologies is emerging as a significant driver for the medical imaging-workstations market. The US Food and Drug Administration (FDA) has been actively working to streamline the approval process for new imaging devices and software, which encourages innovation and market entry. In recent years, the FDA has introduced initiatives aimed at expediting the review of imaging technologies, thereby fostering a more dynamic market environment. This regulatory support not only facilitates the introduction of advanced imaging workstations but also instills confidence among healthcare providers regarding the safety and efficacy of these technologies. As a result, the medical imaging-workstations market is likely to benefit from increased adoption rates and a broader range of available products.