Aging Population

The demographic shift towards an aging population is significantly influencing the Medical Imaging Market. As individuals age, they typically experience a higher incidence of health complications that require diagnostic imaging. The World Health Organization has reported that the proportion of the population aged 60 years and older is expected to double by 2050, which will likely increase the demand for imaging services. This demographic trend suggests that healthcare systems will need to invest in advanced imaging technologies to cater to the needs of older patients. Consequently, the Medical Imaging Market may see substantial growth as healthcare providers seek to enhance their diagnostic capabilities to address age-related health challenges.

Increased Healthcare Expenditure

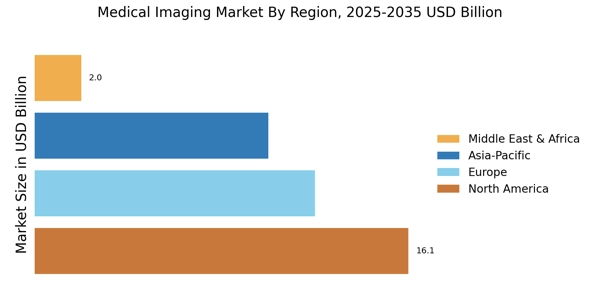

Rising healthcare expenditure across various regions is a crucial driver for the Medical Imaging Market. Governments and private sectors are investing more in healthcare infrastructure, which includes the acquisition of advanced imaging equipment. Data indicates that healthcare spending is expected to rise, with many countries allocating a larger portion of their budgets to medical technologies. This trend is likely to facilitate the adoption of state-of-the-art imaging systems, thereby enhancing diagnostic capabilities. As healthcare providers strive to improve patient care, the Medical Imaging Market stands to gain from increased investments in imaging technologies.

Growing Awareness of Early Diagnosis

There is a growing awareness of the importance of early diagnosis in disease management, which is positively impacting the Medical Imaging Market. Patients and healthcare providers alike recognize that early detection can lead to better treatment outcomes and lower healthcare costs. This awareness is driving demand for imaging services, as more individuals seek preventive screenings and diagnostic tests. Market data suggests that the demand for imaging services is expected to rise, particularly in areas such as oncology and cardiology. As healthcare systems adapt to this shift in patient expectations, the Medical Imaging Market is likely to experience robust growth.

Rising Incidence of Chronic Diseases

The increasing prevalence of chronic diseases such as cancer, cardiovascular disorders, and diabetes is a primary driver of the Medical Imaging Market. As these conditions require regular monitoring and advanced diagnostic techniques, the demand for imaging modalities like MRI, CT scans, and ultrasound is expected to rise. According to recent data, the incidence of cancer alone is projected to increase, necessitating enhanced imaging capabilities for early detection and treatment planning. This trend indicates a growing need for sophisticated imaging technologies, which could potentially lead to a market expansion valued at several billion dollars over the next few years. The Medical Imaging Market is thus poised to benefit from the urgent need for effective diagnostic tools to manage chronic health issues.

Technological Innovations in Imaging Techniques

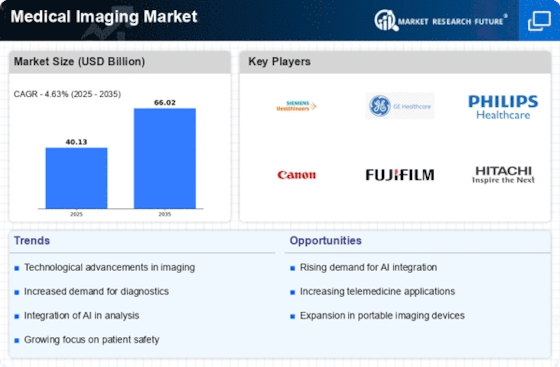

Technological advancements in imaging modalities are transforming the Medical Imaging Market. Innovations such as 3D imaging, artificial intelligence integration, and improved imaging software are enhancing diagnostic accuracy and efficiency. For instance, AI algorithms are being developed to assist radiologists in interpreting images more effectively, potentially reducing diagnostic errors. The market for advanced imaging technologies is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 5% in the coming years. These innovations not only improve patient outcomes but also streamline workflows in healthcare facilities, thereby driving the Medical Imaging Market forward.