Advancements in Technology

The Medical Document Management Systems Market is witnessing transformative advancements in technology that are reshaping the landscape of document management. Innovations such as artificial intelligence, machine learning, and blockchain are enhancing the capabilities of document management systems. These technologies facilitate improved data organization, retrieval, and security, making it easier for healthcare organizations to manage vast amounts of documentation. As these advancements become more prevalent, the market is likely to experience accelerated growth, with organizations seeking to leverage cutting-edge solutions to enhance their document management processes. The integration of these technologies could potentially lead to a market growth rate of around 10% over the next few years.

Increased Regulatory Compliance

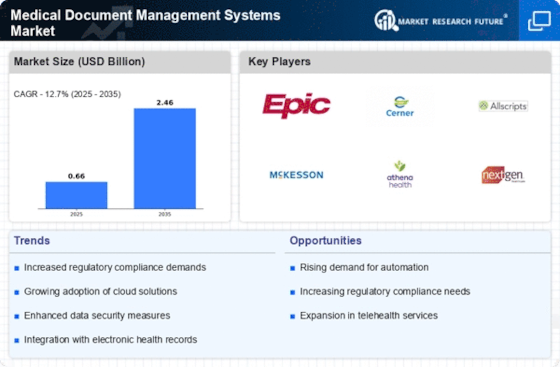

The Medical Document Management Systems Market is experiencing heightened demand due to the increasing regulatory compliance requirements imposed on healthcare organizations. Regulations such as HIPAA and GDPR necessitate stringent data management practices, compelling healthcare providers to adopt robust document management systems. These systems facilitate secure storage, retrieval, and sharing of sensitive patient information, thereby ensuring compliance with legal standards. As organizations strive to avoid hefty fines and legal repercussions, the adoption of medical document management systems is likely to surge. In fact, the market is projected to grow at a compound annual growth rate of approximately 12% over the next five years, driven by the need for compliance and risk management.

Rising Demand for Telehealth Services

The Medical Document Management Systems Market is also being propelled by the rising demand for telehealth services. As healthcare delivery models evolve, the need for efficient document management becomes paramount. Telehealth requires seamless access to patient records and documentation, necessitating the integration of advanced document management systems. These systems enable healthcare providers to manage patient information securely and efficiently, regardless of location. The market is anticipated to expand as telehealth continues to gain traction, with projections indicating a potential growth rate of 15% in the coming years, driven by the increasing acceptance of remote healthcare solutions.

Growing Need for Operational Efficiency

The Medical Document Management Systems Market is significantly influenced by the growing need for operational efficiency within healthcare settings. As healthcare providers face increasing pressure to streamline operations and reduce costs, the implementation of document management systems becomes essential. These systems enhance workflow efficiency by automating document handling processes, reducing manual errors, and expediting access to critical information. Consequently, healthcare organizations can allocate resources more effectively, leading to improved patient care and satisfaction. The market is expected to witness a substantial increase in adoption rates, as organizations recognize the potential for operational improvements and cost savings associated with these systems.

Increased Focus on Patient-Centric Care

The Medical Document Management Systems Market is increasingly influenced by the shift towards patient-centric care models. Healthcare providers are recognizing the importance of maintaining comprehensive and accessible patient records to enhance the quality of care. Document management systems play a crucial role in supporting this shift by ensuring that patient information is readily available to healthcare professionals. This focus on patient-centricity is driving the adoption of advanced document management solutions, as organizations strive to improve patient outcomes and satisfaction. The market is expected to grow as healthcare providers invest in systems that facilitate better communication and collaboration among care teams.