- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Medical Device Reprocessing Market Size Snapshot

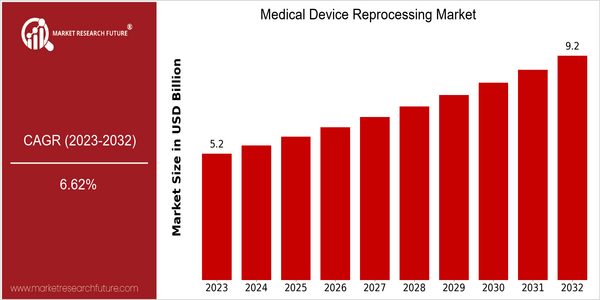

| Year | Value |

|---|---|

| 2023 | USD 5.17 Billion |

| 2032 | USD 9.2 Billion |

| CAGR (2024-2032) | 6.62 % |

Note – Market size depicts the revenue generated over the financial year

The medical device reprocessing market is estimated to reach USD 5.17 billion by 2023 and is expected to reach USD 9.2 billion by 2032, at a CAGR of 6.6% from 2024 to 2032. This growth rate reflects the increasing shift towards sustainable healthcare practices, as hospitals and healthcare facilities are becoming more aware of the economic and environment benefits of reprocessing medical devices. The rising focus on cost containment in the medical industry, along with stricter waste management regulations, is driving the demand for reprocessed devices, which are often more affordable and do not compromise on quality or safety. This market is also backed by technological advances, including improvements in sterilization methods and quality control procedures that ensure the safety and efficacy of reprocessed devices. Moreover, industry players such as Stryker, Medline Industries, and Johnson & Johnson are continuously investing in research and development to enhance reprocessing technology. Strategic initiatives, such as agreements and collaborations, to expand product offerings and market reach, further add to the market’s momentum. Recent collaborations between reprocessing companies and hospitals have helped increase the adoption of reprocessed devices, thereby driving the market’s growth.

Regional Deep Dive

The medical device reprocessing market is experiencing significant growth in various regions, driven by increasing healthcare costs, growing awareness about the environment and stringent regulatory framework. North America is characterized by an advanced health care system and a high prevalence of chronic diseases. Europe is characterized by a strong focus on the environment and regulatory compliance. Asia-Pacific is experiencing rapid growth in the reprocessing market, driven by the expansion of health care and economic growth. Middle East and Africa are experiencing challenges in the form of diverse regulatory framework and economic disparity. Reprocessing is slowly being adopted in Latin America as part of the health care reform.

North America

- The Food and Drug Administration has recently issued a new set of guidelines on the reprocessing of single-use devices, which emphasizes the need for a rigorous system of validation. This will hopefully increase the safety and efficacy of the devices in the market.

- This has led to a new market being created by the development of a new generation of reprocessing systems. The leading companies are investing in automation, which increases the efficiency and reduces the costs, thereby contributing to the growth of the market.

- The increasing attention that health care institutions pay to the environment is leading to a growing number of hospital-reprocessing companies forming links with hospitals.

Europe

- The Medical Device Regulation of the European Union imposes stricter requirements on medical device reprocessing. This requires manufacturers to increase their compliance and quality assurance efforts.

- The development of sterilisation methods, such as ethylene oxide and hydrogen peroxide, is gaining ground in Europe, thereby improving the safety and efficacy of reprocessed medical devices.

- The European Society for Minimally Invasive Neurological Therapy (ESMINT) is campaigning for the use of reprocessed instruments, arguing that this will reduce both waste and health care costs.

Asia-Pacific

- In the United States and Canada, reprocessing is gaining ground, especially in the major medical device manufacturing countries. In China and India, the demand for reprocessing is increasing due to rising costs of health care and growing awareness of the importance of protecting the environment.

- A new organisation, the Asia-Pacific Medical Device Reprocessing Association (APMDRA), has been established to promote best practices and regulatory compliance by reprocessing facilities. It also aims to enhance the credibility of the reprocessing industry.

- Local companies are innovating in reprocessing tailored to the needs of each country. This is expected to lead to greater penetration of the emerging economies.

MEA

- The medical sector in the Middle East and Africa is gradually adopting reprocessing, spurred by the initiatives of the World Health Organization to promote sustainable solutions.

- The regulatory framework is very different in each country. In South Africa, for example, the guidelines for medical device reprocessing are being tightened, which could lead to a greater degree of market standardization.

- Reprocessing is now being considered as a cost-effective solution for hospitals, and this may open up new opportunities in resource-constrained environments.

Latin America

- Brazil and Mexico are beginning to use reprocessing as part of their national health reforms to reduce costs and improve access to medical devices.

- The Latin American Association of Medical Device Reprocessing (ALADIM) is establishing a series of guidelines, which should contribute to the development of the market.

- The improvement of the health system is the opportunity for reprocessing companies to enter the market and offer sustainable solutions.

Did You Know?

“In medicine, about half of the single-use devices can be reprocessed and reused, reducing both waste and costs.” — Association of Medical Device Reprocessors (AMDR)

Segmental Market Size

The Medical Device Reprocessing Market is an important part of the broader health care sector, and is currently undergoing steady growth. This market is playing an important role in the sustainability and cost-effectiveness of the health care system by enabling the safe reuse of medical devices. Increased costs for health care are driving the demand for cost-effective solutions, while tighter regulations are promoting the safe reprocessing of medical devices in order to reduce waste and the impact on the environment.

Future Outlook

From 2023 to 2032, the Medical Device Reprocessing Market is expected to grow at a CAGR of 6.62%. This growth is driven by a growing focus on cost containment in the healthcare industry and the rising awareness of the need for sustainable practices. In order to reduce waste and manage costs, the use of reprocessed medical devices is expected to increase. In some segments, penetration of reprocessed medical devices is expected to reach 30% by 2032, up from around 15% in 2023. This shift is not only driven by economics, but also supports regulatory initiatives aimed at promoting sustainable practices in the industry.

In the foreseeable future, technological advances in the field of sterilization and quality control are expected to drive the market. In the reprocessing field, the use of new materials and automation is expected to increase the safety and effectiveness of reprocessed devices and thus the acceptance of health care professionals. In addition, the regulatory authorities are expected to continue to refine guidelines for the safe reprocessing of medical devices, which will further legitimize and expand the market. Also, the integration of digital health solutions and data analysis into the reprocessing process will play a key role in increasing efficiency and ensuring compliance with increasingly stringent safety standards. Consequently, the reprocessing of medical devices will continue to evolve, driven by a combination of economic, technological and regulatory factors.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 14.7 |

Medical Device Reprocessing Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.