Rising Focus on Infection Control

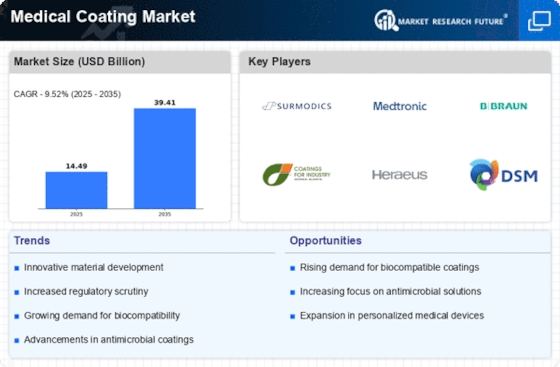

Infection control remains a critical concern in healthcare settings, driving the demand for antimicrobial coatings within the Medical Coating Market. As hospitals and clinics strive to minimize the risk of healthcare-associated infections, the adoption of coatings that inhibit microbial growth is becoming more prevalent. The market for antimicrobial coatings is projected to grow at a rate of approximately 8% annually, reflecting the urgent need for effective infection prevention strategies. This trend is prompting manufacturers to invest in research and development to create coatings that not only protect medical devices but also enhance patient safety. Thus, the Medical Coating Market is likely to evolve in response to these pressing healthcare challenges.

Increasing Demand for Medical Devices

The Medical Coating Market is experiencing a surge in demand for medical devices, driven by an aging population and rising chronic diseases. As healthcare providers seek to enhance patient outcomes, the need for advanced medical coatings that improve device performance becomes paramount. In 2025, the medical device market is projected to reach approximately 600 billion USD, indicating a robust growth trajectory. This growth is likely to propel the demand for specialized coatings that offer properties such as biocompatibility and antimicrobial effects. Consequently, manufacturers are investing in innovative coating technologies to meet these evolving needs, thereby expanding their market presence in the Medical Coating Market.

Regulatory Support for Coating Innovations

Regulatory bodies are increasingly recognizing the importance of advanced coatings in the Medical Coating Market. Initiatives aimed at streamlining the approval process for innovative medical coatings are emerging, which could facilitate faster market entry for new products. For instance, the FDA has introduced programs that encourage the development of novel coatings that enhance device safety and efficacy. This regulatory support may lead to a more dynamic market environment, fostering innovation and competition among manufacturers. As a result, the Medical Coating Market is likely to witness a proliferation of new products that meet stringent safety standards while addressing specific clinical needs.

Growing Investment in Healthcare Infrastructure

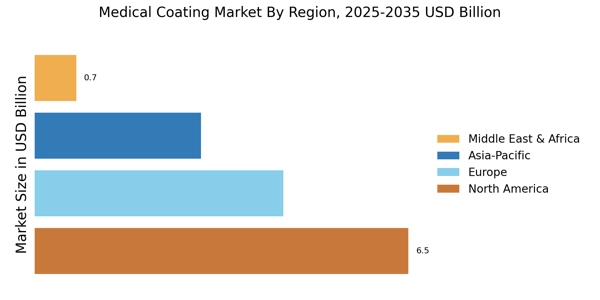

Investment in healthcare infrastructure is on the rise, which is expected to positively impact the Medical Coating Market. Governments and private entities are allocating substantial resources to enhance healthcare facilities, particularly in emerging economies. This investment is likely to lead to an increased demand for medical devices, subsequently driving the need for advanced coatings that improve device performance and longevity. As healthcare systems expand, the requirement for innovative medical coatings that meet diverse clinical needs will become more pronounced. Consequently, the Medical Coating Market is poised for growth as it aligns with the broader trends in healthcare infrastructure development.

Technological Advancements in Coating Processes

Technological advancements in coating processes are transforming the Medical Coating Market. Innovations such as plasma spraying, electrospinning, and advanced deposition techniques are enabling the development of coatings with superior properties. These technologies allow for the creation of coatings that are not only biocompatible but also possess enhanced durability and functionality. The market for advanced coating technologies is expected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This growth is indicative of the increasing reliance on sophisticated coating solutions to meet the demands of modern medical applications, thereby shaping the future of the Medical Coating Market.