Focus on Regulatory Compliance

The emphasis on regulatory compliance is a significant driver of the Medical Billing Outsourcing Market. Healthcare providers face a complex landscape of regulations, including HIPAA and various payer requirements, which necessitate meticulous attention to billing practices. Outsourcing billing services allows organizations to leverage the expertise of specialized firms that are well-versed in compliance issues. This not only mitigates the risk of costly penalties but also ensures that billing practices align with current regulations. As compliance becomes increasingly critical, the Medical Billing Outsourcing Market is poised for growth, as more providers seek to ensure adherence to regulatory standards while focusing on core healthcare services.

Increased Focus on Patient Experience

The growing emphasis on patient experience is influencing the Medical Billing Outsourcing Market. Healthcare providers are recognizing that streamlined billing processes contribute to overall patient satisfaction. Complicated billing practices can lead to confusion and frustration among patients, potentially impacting their perception of care. By outsourcing billing services, providers can ensure that patients receive clear and accurate billing information, enhancing their overall experience. This focus on patient-centric care is driving healthcare organizations to seek efficient billing solutions that align with their commitment to quality service. As patient experience becomes a priority, the Medical Billing Outsourcing Market is expected to expand as providers invest in outsourcing to improve their billing processes.

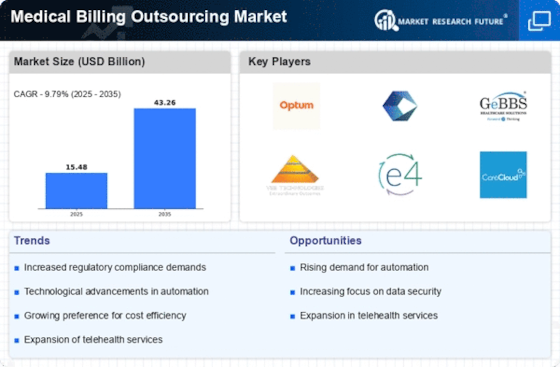

Rising Demand for Healthcare Services

The increasing demand for healthcare services is a primary driver of the Medical Billing Outsourcing Market. As populations age and chronic diseases become more prevalent, healthcare providers are experiencing a surge in patient volume. This trend necessitates efficient billing processes to manage the growing complexity of claims and reimbursements. According to recent data, healthcare spending is projected to rise significantly, leading to an estimated increase in the outsourcing of billing services. Providers are increasingly turning to outsourcing to streamline operations, reduce administrative burdens, and enhance revenue cycle management. Consequently, the Medical Billing Outsourcing Market is likely to expand as healthcare organizations seek to improve their financial performance while maintaining high-quality patient care.

Cost Reduction and Financial Optimization

Cost reduction remains a pivotal driver in the Medical Billing Outsourcing Market. Healthcare organizations are under constant pressure to optimize their financial performance while managing operational costs. Outsourcing billing functions can lead to significant savings by reducing the need for in-house staff and infrastructure. Studies indicate that organizations that outsource their billing processes can achieve a reduction in operational costs by up to 30%. This financial incentive is compelling for many providers, prompting them to consider outsourcing as a viable strategy for enhancing profitability. As the need for financial optimization continues to grow, the Medical Billing Outsourcing Market is likely to see increased adoption of these services.

Technological Advancements in Billing Solutions

Technological advancements are reshaping the Medical Billing Outsourcing Market, driving efficiency and accuracy in billing processes. Innovations such as artificial intelligence, machine learning, and advanced analytics are being integrated into billing systems, enabling faster processing and reduced errors. These technologies facilitate real-time data analysis, which can enhance decision-making and improve revenue cycle management. As healthcare organizations increasingly adopt these technologies, the demand for outsourcing billing services is expected to rise. The Medical Billing Outsourcing Market is likely to benefit from these advancements, as providers seek to leverage technology to optimize their billing operations and improve overall financial health.