Rising Demand for Gaming Keyboards

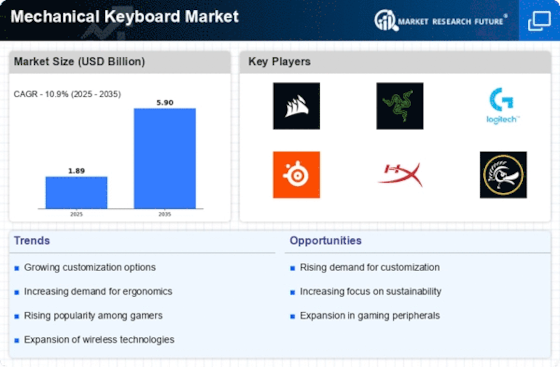

The Mechanical Keyboard Market experiences a notable surge in demand for gaming keyboards, driven by the increasing popularity of eSports and competitive gaming. As gamers seek enhanced performance and responsiveness, mechanical keyboards are favored for their tactile feedback and durability. Recent data indicates that the gaming segment constitutes a substantial portion of the overall mechanical keyboard market, with projections suggesting a growth rate of approximately 10% annually. This trend is further fueled by the introduction of advanced features such as customizable RGB lighting and programmable keys, which appeal to both casual and professional gamers. Consequently, manufacturers are focusing on developing specialized gaming keyboards that cater to the unique preferences of this demographic, thereby solidifying their position within the Mechanical Keyboard Market.

Increased Focus on Aesthetics and Design

The Mechanical Keyboard Market is experiencing a shift towards aesthetics and design, as consumers increasingly prioritize visual appeal alongside functionality. Customization options, such as keycap designs and chassis finishes, are becoming essential selling points for manufacturers. This trend is particularly pronounced among younger consumers who seek unique and personalized products that reflect their individual styles. Market data indicates that the demand for aesthetically pleasing mechanical keyboards has risen by approximately 20% in recent years, prompting brands to collaborate with artists and designers to create limited edition models. This focus on design not only enhances the user experience but also positions mechanical keyboards as lifestyle products, further expanding their market reach. Consequently, the Mechanical Keyboard Market is adapting to these consumer preferences, ensuring that design innovation remains at the forefront of product development.

Expansion of E-commerce and Online Retail

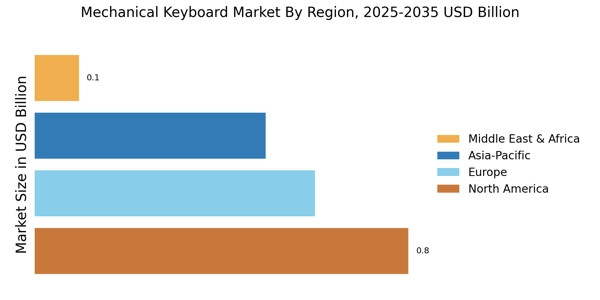

The Mechanical Keyboard Market is benefiting from the expansion of e-commerce and online retail platforms. As consumers increasingly turn to online shopping for convenience and variety, the accessibility of mechanical keyboards has improved significantly. Data suggests that online sales channels now account for over 50% of total keyboard sales, reflecting a shift in consumer purchasing behavior. This trend is further supported by the rise of niche online retailers specializing in mechanical keyboards, which cater to specific consumer needs and preferences. Additionally, the availability of detailed product reviews and user feedback online enhances consumer confidence in purchasing decisions. As a result, the Mechanical Keyboard Market is likely to see continued growth, driven by the increasing reliance on digital platforms for product discovery and acquisition.

Growth of Remote Work and Online Learning

The Mechanical Keyboard Market is witnessing a transformation due to the growth of remote work and online learning. As more individuals engage in telecommuting and virtual education, the demand for high-quality typing solutions has escalated. Mechanical keyboards are increasingly recognized for their superior typing experience, which enhances productivity and comfort during extended use. Market analysis reveals that the segment catering to professionals and students has expanded significantly, with a projected increase in sales of around 15% over the next few years. This shift underscores the importance of ergonomic and efficient typing tools in the modern workspace, prompting manufacturers to innovate and offer products that meet the evolving needs of consumers. The Mechanical Keyboard Market is thus adapting to these changes, ensuring that it remains relevant in a rapidly evolving environment.

Technological Advancements in Key Switches

Technological advancements in key switch mechanisms are playing a pivotal role in shaping the Mechanical Keyboard Market. Innovations such as optical switches and hybrid switches are gaining traction, offering users enhanced performance and faster response times. These developments cater to a diverse range of consumers, from gamers to typists, who seek improved accuracy and speed. Recent estimates suggest that the introduction of these advanced switches could lead to a market expansion of approximately 12% in the coming years. Furthermore, manufacturers are increasingly investing in research and development to create proprietary switch technologies that differentiate their products in a competitive landscape. As a result, the Mechanical Keyboard Market is poised for significant growth, driven by the continuous evolution of key switch technology.