Government Support and Incentives

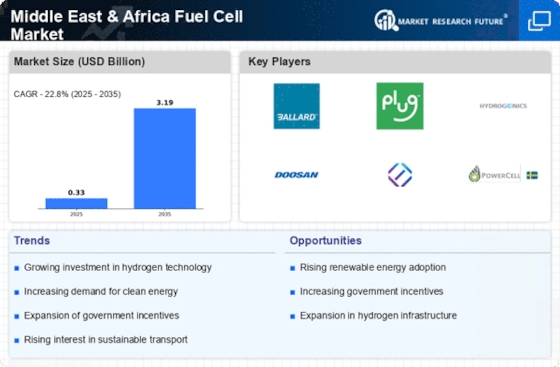

The MEA Fuel Cell Market is experiencing a surge in government support and incentives aimed at promoting clean energy technologies. Various governments in the Middle East and Africa are implementing policies that encourage the adoption of fuel cells, including tax breaks, grants, and subsidies. For instance, the United Arab Emirates has set ambitious targets for renewable energy, which includes the integration of fuel cell technologies. This governmental backing not only enhances the financial viability of fuel cell projects but also fosters a conducive environment for research and development. As a result, the MEA Fuel Cell Market is likely to witness accelerated growth, with projections indicating a compound annual growth rate (CAGR) of over 15% in the coming years.

Growing Interest in Hydrogen Economy

The MEA Fuel Cell Market is witnessing a growing interest in the hydrogen economy, which is seen as a key driver for future energy systems. Countries in the region are exploring hydrogen production, storage, and distribution as part of their energy strategies. For instance, Saudi Arabia is investing heavily in hydrogen production projects, aiming to become a global leader in hydrogen exports. This focus on hydrogen not only supports the fuel cell market but also aligns with global trends towards decarbonization. The establishment of hydrogen infrastructure is expected to facilitate the growth of the MEA Fuel Cell Market, with potential collaborations between governments and private entities to develop hydrogen supply chains.

Increased Investment from Private Sector

The MEA Fuel Cell Market is benefiting from increased investment from the private sector, which is recognizing the potential of fuel cell technologies. Major corporations are allocating resources towards research and development, as well as pilot projects that demonstrate the viability of fuel cells in various applications. For example, companies in the automotive sector are exploring fuel cell vehicles as a sustainable alternative to traditional combustion engines. This influx of private capital is likely to accelerate innovation and commercialization within the MEA Fuel Cell Market, with forecasts suggesting that private investments could reach USD 500 million by 2027, further solidifying the market's growth trajectory.

Rising Demand for Clean Energy Solutions

The MEA Fuel Cell Market is increasingly driven by the rising demand for clean energy solutions. As countries in the region grapple with environmental challenges and the need for sustainable energy sources, fuel cells present a viable alternative. The growing awareness of climate change and the need to reduce greenhouse gas emissions are propelling both public and private sectors to explore fuel cell technologies. For example, South Africa is investing in hydrogen fuel cell projects to diversify its energy mix and reduce reliance on fossil fuels. This shift towards cleaner energy sources is expected to bolster the MEA Fuel Cell Market, with analysts estimating a market size expansion to reach USD 1 billion by 2028.

Technological Advancements in Fuel Cell Systems

Technological advancements in fuel cell systems are playing a pivotal role in shaping the MEA Fuel Cell Market. Innovations in materials, such as proton exchange membranes and catalysts, are enhancing the efficiency and durability of fuel cells. Moreover, the development of hybrid systems that combine fuel cells with renewable energy sources is gaining traction. These advancements not only improve the performance of fuel cells but also reduce costs, making them more accessible to various industries. As a result, the MEA Fuel Cell Market is likely to benefit from increased adoption across sectors such as transportation, stationary power generation, and industrial applications, potentially leading to a market valuation of USD 2 billion by 2030.