Maternity Personal Care Size

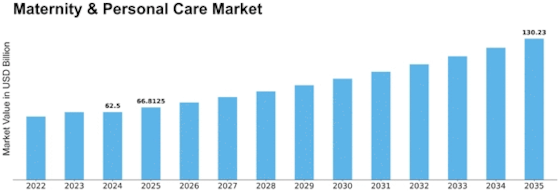

Maternity & Personal Care Market Growth Projections and Opportunities

The maternity personal care market operates within a dynamic environment shaped by various factors, including demographic trends, consumer preferences, regulatory influences, and technological advancements. As women transition through pregnancy and motherhood, their skincare and personal care needs undergo significant changes, driving demand for specialized products tailored to address these unique requirements.

One of the primary drivers shaping the maternity personal care market is demographic trends. With increasing global population and rising birth rates in many regions, the number of expectant mothers seeking maternity personal care products is expanding. This demographic shift fuels demand for a wide range of skincare, body care, and wellness products designed specifically for pregnant women and new mothers.

Consumer preferences also play a crucial role in shaping the market dynamics of maternity personal care products. Today's consumers are increasingly conscious of ingredient safety, sustainability, and transparency in product formulations. As a result, there is a growing demand for natural, organic, and eco-friendly maternity personal care products free from harmful chemicals, synthetic fragrances, and other potentially harmful substances. Manufacturers and brands that align with these consumer preferences stand to gain a competitive edge in the market.

Moreover, societal trends and cultural norms influence the maternity personal care market dynamics. In many societies, pregnancy and motherhood are celebrated milestones, and expectant mothers prioritize self-care and pampering during this transformative journey. This cultural emphasis on maternal well-being drives demand for luxurious, indulgent, and spa-like maternity personal care experiences, including skincare treatments, massage oils, bath products, and aromatherapy solutions.

Regulatory influences also shape the market dynamics of maternity personal care products, with government agencies imposing stringent regulations to ensure product safety, efficacy, and labeling compliance. Manufacturers must navigate complex regulatory frameworks and adhere to standards governing ingredients, manufacturing practices, product claims, and marketing communications. Compliance with these regulations is essential for maintaining consumer trust and brand reputation in the maternity personal care market.

Furthermore, technological advancements drive innovation and product development within the maternity personal care industry. From advanced skincare formulations to wearable tech devices designed to monitor maternal health and wellness, technology plays a pivotal role in addressing the evolving needs of expectant mothers and new mothers. Manufacturers leverage cutting-edge research, scientific discoveries, and technological innovations to create next-generation maternity personal care products that offer enhanced benefits and efficacy.

Market competition also shapes the dynamics of the maternity personal care market, with numerous brands vying for market share and consumer attention. Established skincare companies, niche maternity brands, direct-to-consumer startups, and natural beauty retailers compete to differentiate themselves through product innovation, marketing strategies, pricing tactics, and distribution channels. Brands that effectively communicate their unique value proposition, resonate with their target audience, and deliver exceptional product experiences gain a competitive advantage in this crowded marketplace.

Additionally, economic factors such as disposable income levels, purchasing power, and consumer spending habits influence the demand for maternity personal care products. During periods of economic prosperity, expectant mothers may be more inclined to invest in premium skincare and wellness products to indulge in self-care and pampering. Conversely, economic downturns or financial constraints may prompt consumers to seek more affordable options or prioritize essential purchases over discretionary spending on maternity personal care items.

Leave a Comment