Increased Demand for Efficiency

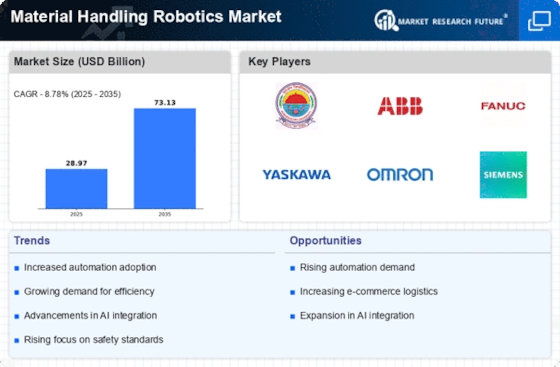

The Material Handling Robotics Market is experiencing a surge in demand for efficiency across various sectors. Companies are increasingly recognizing the need to streamline operations and reduce costs. Robotics technology offers solutions that enhance productivity by automating repetitive tasks, thereby allowing human workers to focus on more complex activities. According to recent data, the adoption of material handling robots can lead to a productivity increase of up to 30%. This trend is particularly evident in manufacturing and warehousing, where the integration of robotics is seen as a critical factor in maintaining competitive advantage. As businesses strive to optimize their supply chains, the Material Handling Robotics Market is poised for substantial growth.

Focus on Supply Chain Resilience

The Material Handling Robotics Market is increasingly shaped by the focus on supply chain resilience. Companies are recognizing the importance of building robust supply chains that can withstand disruptions. Robotics technology offers solutions that enhance flexibility and responsiveness in material handling operations. By automating key processes, businesses can quickly adapt to changing market conditions and customer demands. Data suggests that organizations that invest in automation are better positioned to navigate supply chain challenges, leading to a more resilient operational framework. This emphasis on resilience is likely to fuel further investment in the Material Handling Robotics Market.

Rising E-commerce and Retail Demand

The Material Handling Robotics Market is being propelled by the rising demand from the e-commerce and retail sectors. As online shopping continues to grow, companies are seeking efficient ways to manage inventory and fulfill orders. Robotics technology plays a crucial role in automating these processes, leading to faster order processing and improved accuracy. Recent statistics indicate that e-commerce fulfillment centers that utilize robotics can achieve up to 50% faster order processing times. This trend is likely to persist as consumer expectations for rapid delivery continue to rise, further driving the growth of the Material Handling Robotics Market.

Technological Advancements in Robotics

Technological advancements are a key driver of the Material Handling Robotics Market. Innovations in artificial intelligence, machine learning, and sensor technology are enabling the development of more sophisticated and capable robotic systems. These advancements allow robots to perform complex tasks with greater precision and adaptability. For example, the introduction of collaborative robots, or cobots, has transformed the way material handling is approached, allowing for safer and more efficient human-robot interactions. As technology continues to evolve, the Material Handling Robotics Market is expected to expand, with companies increasingly investing in cutting-edge solutions to enhance their operational capabilities.

Labor Shortages and Workforce Challenges

The Material Handling Robotics Market is significantly influenced by ongoing labor shortages and workforce challenges. Many industries are facing difficulties in finding skilled labor, which has prompted companies to turn to automation as a viable solution. The integration of robotics in material handling not only addresses the labor gap but also enhances operational efficiency. For instance, the logistics sector has reported a 20% increase in operational efficiency after implementing robotic solutions. This shift towards automation is likely to continue as businesses seek to mitigate risks associated with labor shortages, thereby driving growth in the Material Handling Robotics Market.