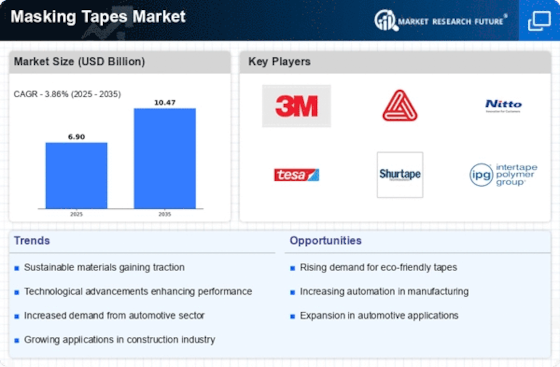

Rising Demand in Automotive Sector

The automotive sector appears to be a significant driver for the Masking Tapes Market. As manufacturers increasingly focus on enhancing vehicle aesthetics and performance, the demand for high-quality masking tapes is likely to rise. These tapes are essential for painting, surface protection, and component assembly, ensuring precision and quality in production. In 2025, the automotive industry is projected to account for a substantial share of the masking tapes market, driven by innovations in vehicle design and manufacturing processes. The need for efficient and reliable masking solutions in automotive applications suggests a robust growth trajectory for the masking tapes market.

Growth in Electronics Manufacturing

The electronics manufacturing sector is emerging as a crucial driver for the Masking Tapes Market. As the production of electronic devices continues to expand, the need for specialized masking solutions is becoming more pronounced. Masking tapes are utilized in various processes, including PCB assembly and surface protection during manufacturing. In 2025, the electronics industry is projected to account for a notable share of the masking tapes market, driven by advancements in technology and increasing consumer demand for electronic products. This trend suggests that the masking tapes market will likely experience sustained growth as it caters to the specific requirements of electronics manufacturers.

Increased Focus on Aesthetic Appeal

The heightened focus on aesthetic appeal in various industries is likely to drive the Masking Tapes Market. As businesses strive to enhance the visual aspects of their products, the demand for high-quality masking tapes for painting and finishing applications is expected to rise. In 2025, industries such as furniture, home decor, and consumer goods are anticipated to contribute significantly to market growth, as manufacturers seek to achieve flawless finishes. The ability of masking tapes to provide clean edges and protect surfaces during painting processes indicates a strong potential for growth in this segment of the market.

Expansion of Construction Activities

The ongoing expansion of construction activities is likely to bolster the Masking Tapes Market. With urbanization and infrastructure development on the rise, the demand for masking tapes in painting, drywall installation, and surface protection is expected to increase. In 2025, the construction sector is anticipated to contribute significantly to the overall market growth, as contractors and builders seek reliable solutions for achieving clean lines and protecting surfaces during projects. The versatility of masking tapes in various construction applications indicates a promising outlook for the industry, as it adapts to meet the evolving needs of construction professionals.

Technological Innovations in Product Development

Technological innovations in product development are poised to influence the Masking Tapes Market positively. Manufacturers are increasingly investing in research and development to create advanced masking tapes that offer superior adhesion, temperature resistance, and ease of use. In 2025, the introduction of new formulations and materials is expected to enhance the performance of masking tapes, catering to the diverse needs of various industries. This trend suggests that the masking tapes market will likely benefit from ongoing advancements, as companies strive to meet the evolving demands of consumers and industries alike.