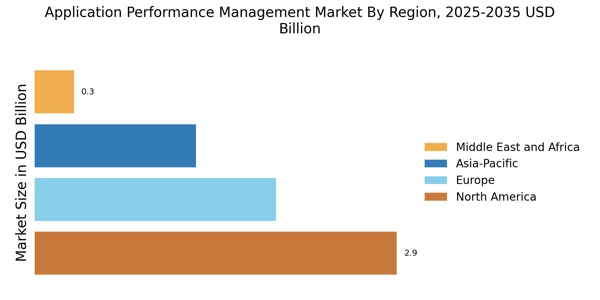

North America : Market Leader in Innovation

North America is the largest market for Application Performance Management Market (APM), holding approximately 45% of the global share. The region's growth is driven by the increasing adoption of cloud-based solutions, the rise of digital transformation initiatives, and stringent regulatory requirements that demand high performance and reliability. Companies are investing heavily in APM tools to enhance user experience and operational efficiency. The United States is the leading country in this market, with major players like Dynatrace, New Relic, and AppDynamics headquartered here. The competitive landscape is characterized by rapid technological advancements and a focus on AI-driven solutions. Canada also contributes significantly, with a growing emphasis on cybersecurity and performance monitoring, further solidifying North America's position as a hub for APM innovation.

Europe : Emerging Market with Growth Potential

Europe is witnessing a robust growth trajectory in the Application Performance Management Market, accounting for approximately 30% of the global share. The region's growth is fueled by increasing digitalization across various sectors, coupled with regulatory frameworks that emphasize data protection and performance standards. The General Data Protection Regulation (GDPR) has catalyzed the need for effective APM solutions to ensure compliance and enhance user trust.

Leading countries in Europe include Germany, the UK, and France, where companies are increasingly adopting APM tools to optimize their IT infrastructure. The competitive landscape features key players like Micro Focus and IBM, who are innovating to meet the diverse needs of European businesses. The presence of numerous SMEs also contributes to a dynamic Application Performance Management Market environment, fostering innovation and competition.

Asia-Pacific : Rapidly Growing Digital Economy

Asia-Pacific is emerging as a significant player in the Application Performance Management Market, holding around 20% of the global share. The region's growth is driven by the rapid digital transformation across industries, increasing internet penetration, and a growing emphasis on customer experience. Countries like India and China are leading this surge, supported by government initiatives promoting digital infrastructure and innovation. India is particularly noteworthy, with a burgeoning IT sector and a strong presence of companies like ManageEngine. The competitive landscape is evolving, with local players and The Application Performance Management Market share. The region's diverse industries, from e-commerce to finance, are increasingly recognizing the importance of APM tools to enhance operational efficiency and customer satisfaction, further propelling market growth.

Middle East and Africa : Emerging Market with Unique Challenges

The Middle East and Africa region is gradually emerging in the Application Performance Management Market, currently holding about 5% of the global share. The growth is primarily driven by increasing investments in IT infrastructure and a rising demand for digital services. However, challenges such as regulatory hurdles and varying levels of technological adoption across countries can impact market dynamics. Countries like South Africa and the UAE are leading the charge, focusing on enhancing their digital capabilities.

In South Africa, the government is promoting initiatives to boost the digital economy, which is encouraging the adoption of APM solutions. The competitive landscape is characterized by a mix of local and international players, with companies looking to tailor their offerings to meet regional needs. As businesses increasingly recognize the importance of application performance, the Application Performance Management Market is poised for significant growth in the coming years.