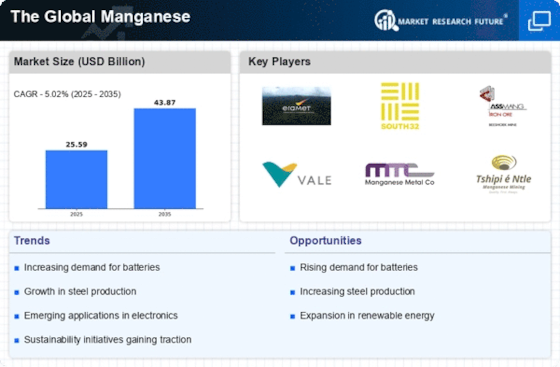

Rising Steel Production

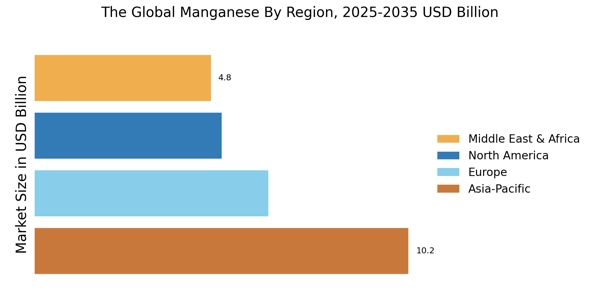

The global steel industry continues to be one of the most critical pillars of industrial development, with crude steel production reaching 1,884.6 million tonnes in 2024. Despite short-term fluctuations driven by economic cycles, energy prices, and regional geopolitical pressures, steel remains indispensable across construction, infrastructure, automotive, machinery, shipbuilding, and energy sectors. Emerging economies—particularly India, Southeast Asia, the Middle East, and parts of Africa—are experiencing strong urbanization-led demand, while developed markets focus on modernization, green energy systems, and manufacturing reshoring. Even with minor declines in some regions, the broader structural demand for steel remains stable due to global investments in transportation networks, renewable power installations, industrial capacity expansion, and housing. As steel consumption grows and evolves, the need for high-quality alloying materials becomes increasingly important to achieve performance, durability, and efficiency targets in end-use applications. long-term supply strategies.

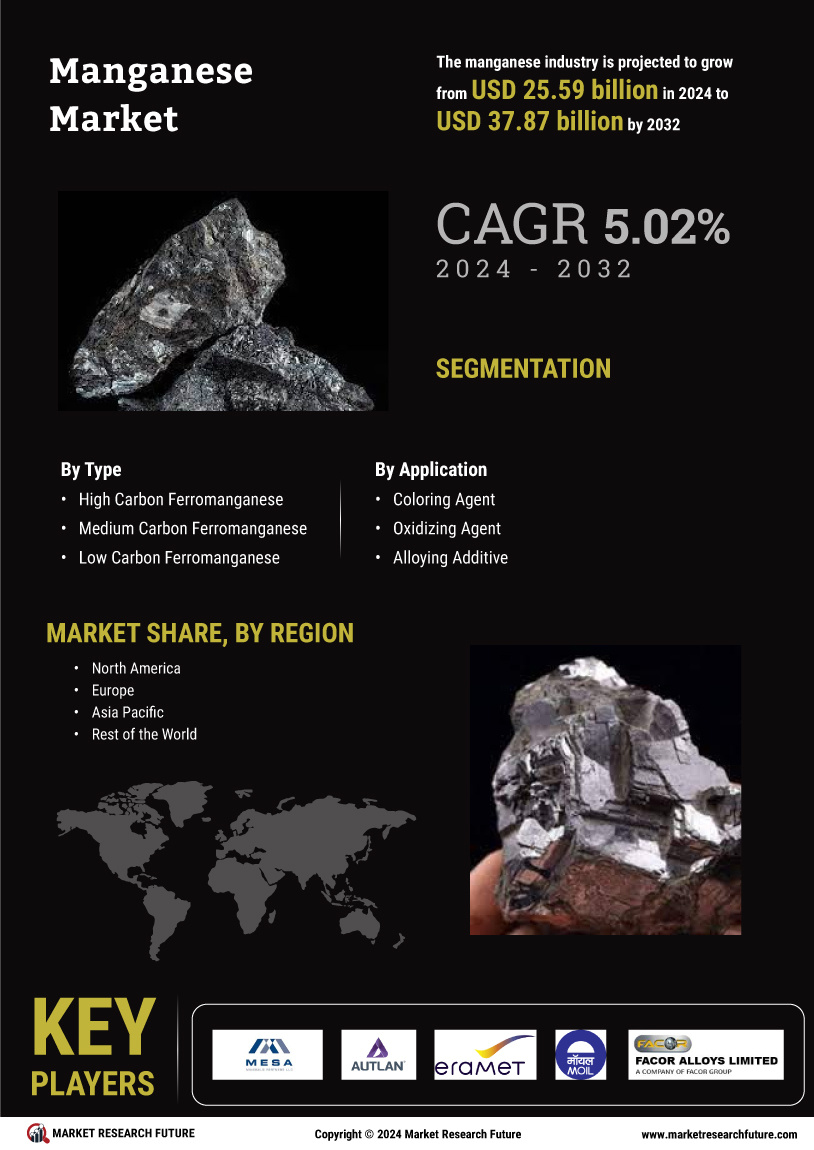

Manganese plays an indispensable role in the global steelmaking value chain, making it one of the most strategically significant industrial metals. Around 85–90% of all manganese produced globally is consumed by the steel industry in the form of ferromanganese, silicomanganese, and other refining alloys. Manganese is critical for steel deoxidation, desulphurization, and alloying, enhancing tensile strength, toughness, wear resistance, and hardenability. Without manganese, large-scale steel production would be technically and economically unfeasible, as it prevents hot shortness and allows impurities to be effectively controlled during smelting. The shift toward higher-strength, specialty, and low-carbon steels further increases reliance on manganese alloys. As electric arc furnace (EAF) capacity expands globally—particularly in India, the U.S., Türkiye, and Europe—the demand for manganese will continue to scale, since EAF scrap melting requires significant manganese additions. Overall, rising steel production and the evolving steel grade mix firmly position manganese as a critical input material in the global metallurgical and industrial ecosystem.

Rising Global Ev Adoption

The rapid expansion in global EV sales remains the strongest structural force driving manganese consumption, especially for high-purity manganese sulfate used in cathode materials. Between 2023 and 2024, China continued to dominate with BEV sales rising from 5.4 million to 6.4 million and PHEVs surging from 2.7 million to 4.9 million, creating immense pressure on battery mineral supply chains. Europe maintained stable BEV sales at 2.2 million, while the US market grew moderately from 1.1 to 1.2 million BEVs. Rest-of-world markets also expanded, from 0.8 to 1.0 million BEVs and 0.2 to 0.3 million PHEVs, broadening global manganese demand geographically. This rising EV penetration directly increases manganese deployment in batteries. According to Adamas Intelligence, global manganese deployed in EV batteries reached 19,131 tonnes in Q3 2023 (up 30% YoY), and 7,048 tonnes in Nov 2023 alone (up 23% YoY). This reflects unprecedented scaling of manganese-rich cathodes in global EV production. Although average manganese per battery is falling, total manganese consumption continues rising sharply because of rapidly increasing EV volumes.

As global EV sales surpassed 15 million units in 2024, the cumulative demand for battery-grade manganese has moved from a niche component to one of the most strategically important minerals for the clean mobility transition. Manganese is an essential stabilizing component in several major EV battery chemistries, including Nickel–Manganese–Cobalt (NMC) and Lithium Manganese Oxide (LMO), while also gaining importance in emerging chemistries such as LMFP (Lithium Manganese Iron Phosphate) and high-manganese NMx formulations. These chemistries together accounted for tens of thousands of tonnes of manganese deployment in EVs in 2023–2024. Adamas Intelligence data shows manganese in the average EV battery stood at ~2.7 kg from Jan–Apr 2025, with BEVs averaging ~4.2 kg, despite an 18–21% annual decline due to rising LFP adoption. Yet total manganese use grew because EV production volumes rose significantly. \

Technologically, manganese improves thermal stability, enhances structural integrity of cathodes, and supports cost-effective high-energy chemistries that reduce reliance on cobalt. LMFP—an advanced derivative of LFP—achieves higher energy density by integrating manganese, enabling automakers to competitively position mid-range EVs. SFA Oxford estimates LMFP cathodes may require 50–60 kg of manganese per vehicle in their active material, making them strategically important for mass-market EVs. As battery manufacturers scale output for grid storage, two-wheeler electrification, and cost-sensitive EV segments, manganese remains central to cathode innovation and global supply-chain planning. High-manganese cathode technologies are emerging as a pivotal enabler of global EV affordability, safety, and performance. These chemistries reduce dependence on expensive cobalt and geopolitically sensitive nickel while offering improved thermal stability—an essential requirement as EVs transition toward longer range and ultra-fast charging. As the mass-market EV segment expands, OEMs are increasingly shifting toward manganese-rich cathodes that offer competitive energy density at lower cost. This shift aligns with global EV adoption patterns, where annual EV sales grew beyond 15 million units in 2024, driven heavily by China’s BEV and PHEV boom.

Growing Demand In Green Steel Initiatives

The global steel industry is under unprecedented pressure to decarbonize, and this directly enhances the strategic relevance of manganese. In 2024, every tonne of steel produced emitted an average of 2.18 tonnes of CO₂e, with total sector emissions reaching 4.1 billion tonnes CO₂e, accounting for 7–8% of global anthropogenic GHG emissions. The traditional BF–BOF route, which still dominates global steelmaking, emits 2.66 t CO₂e per tonne, far higher than Scrap–EAF (0.71 t) or DRI–EAF (1.66 t). Green steel initiatives seek to reduce these emissions through low-carbon ironmaking, renewable-powered electric arc furnaces, hydrogen-based DRI, and enhanced recycling.

In all these pathways, manganese becomes increasingly essential as a performance-enabling alloy. High-manganese steels offer enhanced strength, ductility, and wear resistance, allowing steelmakers to maintain or improve mechanical properties while transitioning to green production routes. Moreover, as scrap usage rises in EAF-based green steel, manganese additions are required to correct chemistry and compensate for impurities. Therefore, the shift from carbon-intensive to low-carbon steelmaking processes significantly elevates manganese demand, making it a critical metallurgical ingredient in the global decarbonization roadmap.

Hydrogen-based DRI and renewable electricity-powered EAFs are emerging as cornerstone technologies for green steel, and both rely heavily on manganese to achieve desired metallurgical performance. As the industry moves away from coke-based blast furnaces toward DRI–EAF routes, emissions drop significantly—from 2.66 t CO₂e/tonne (BF–BOF) to 1.66 t CO₂e/tonne (DRI–EAF)—with the potential for near-zero emissions when using green hydrogen and renewable electricity. However, DRI/EAF steelmaking produces different impurity profiles and requires higher alloying additions to reach the mechanical performance of BF–BOF steel. Manganese plays a critical role by acting as a deoxidizer, desulfurizer, and strengthening alloy, making it indispensable for producing high-quality green steel.