Increased Focus on Mobile Gaming

The smartphone Market in Malaysia is witnessing a notable shift towards mobile gaming, which is becoming a significant driver of smartphone sales. With the proliferation of high-performance smartphones equipped with advanced graphics and processing capabilities, gaming enthusiasts are increasingly opting for devices that enhance their gaming experience. As of November 2025, it is estimated that mobile gaming accounts for approximately 30% of total smartphone usage in Malaysia. This trend is further fueled by the availability of popular gaming titles and the rise of esports, which has created a vibrant gaming community. Consequently, manufacturers are likely to focus on producing smartphones with features tailored for gamers, such as improved battery life and enhanced cooling systems. This growing interest in mobile gaming is expected to have a substantial impact on the smartphone Market, driving innovation and competition among brands.

Expansion of Online Retail Platforms

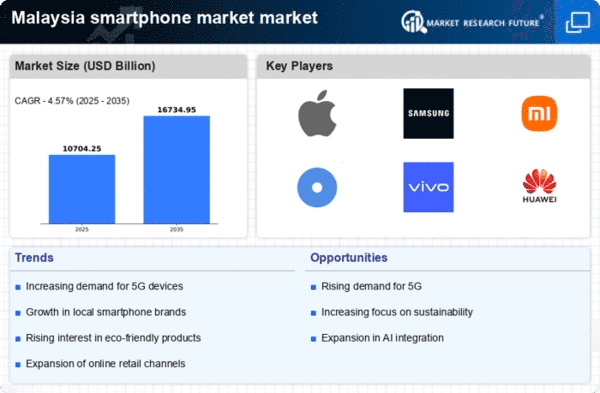

The smartphone Market in Malaysia is significantly influenced by the expansion of online retail platforms. As consumers increasingly turn to e-commerce for their shopping needs, the accessibility of smartphones through various online channels is enhancing market growth. Data indicates that online sales of smartphones have surged by approximately 25% in the past year, reflecting a shift in consumer purchasing behavior. This trend is likely to continue as more Malaysians embrace the convenience of online shopping, particularly for technology products. Retailers are also leveraging digital marketing strategies to reach a broader audience, which may further stimulate demand. The ability to compare prices and read reviews online empowers consumers, making them more informed buyers. This shift towards online retail is expected to play a crucial role in shaping the smartphone Market landscape in Malaysia.

Rising Disposable Income Among Consumers

In Malaysia, the smartphone Market is benefiting from an increase in disposable income among consumers. As economic conditions improve, more individuals are willing to invest in high-quality smartphones that offer advanced features and capabilities. Data suggests that the average disposable income in Malaysia has risen by approximately 15% over the past few years, which correlates with a growing trend of smartphone ownership. This increase in financial capability allows consumers to prioritize technology in their purchasing decisions, leading to a higher demand for premium devices. Additionally, the trend of financing options and installment plans offered by retailers is making it easier for consumers to acquire smartphones, further stimulating the market. The combination of rising income levels and accessible payment methods is likely to continue driving growth in the smartphone Market.

Growing Demand for Enhanced Security Features

In the context of the smartphone Market in Malaysia, there is an increasing demand for enhanced security features among consumers. As concerns regarding data privacy and cybersecurity continue to rise, individuals are seeking smartphones that offer robust security measures. Features such as biometric authentication, encryption, and secure operating systems are becoming essential considerations for consumers when selecting a device. Recent surveys indicate that approximately 60% of Malaysian smartphone users prioritize security features in their purchasing decisions. This trend is likely to drive manufacturers to innovate and incorporate advanced security technologies into their devices. The emphasis on security not only addresses consumer concerns but also enhances brand loyalty, as users are more inclined to choose brands that prioritize their data protection. Consequently, the growing focus on security is expected to significantly influence the smartphone Market in Malaysia.

Technological Advancements in Mobile Connectivity

The smartphone Market in Malaysia is experiencing a surge in demand due to rapid advancements in mobile connectivity technologies. The rollout of 5G networks is particularly noteworthy, as it enhances data speeds and connectivity reliability. This technological evolution is likely to drive consumer interest in upgrading to newer smartphone models that support 5G capabilities. As of November 2025, it is estimated that 5G penetration in Malaysia could reach approximately 40%, significantly influencing purchasing decisions. Furthermore, the integration of advanced features such as augmented reality and artificial intelligence in smartphones is expected to attract tech-savvy consumers, thereby propelling growth in the smartphone Market. The increasing reliance on mobile devices for various applications, including remote work and online education, further underscores the importance of connectivity in shaping consumer preferences.