Aging Infrastructure

The deterioration of aging infrastructure across various sectors is a pressing concern that propels the Global Maintenance, Repair and Overhaul Market. Many industries, including transportation, energy, and manufacturing, are grappling with outdated equipment that requires extensive maintenance and repair. The need to upgrade or replace aging assets is becoming increasingly urgent, as failure to do so can lead to operational inefficiencies and safety hazards. Reports indicate that substantial investments are needed to modernize infrastructure, with estimates suggesting trillions of dollars required globally over the next decade. This scenario presents a significant opportunity for MRO service providers to cater to the growing demand for maintenance and repair solutions.

Regulatory Compliance

Stringent regulations regarding safety, emissions, and operational efficiency are compelling organizations to invest in maintenance, repair, and overhaul activities. The Global Maintenance, Repair and Overhaul Market is increasingly influenced by compliance requirements that mandate regular inspections and maintenance of equipment. For example, aviation and automotive sectors face rigorous standards that necessitate adherence to maintenance protocols. Failure to comply can result in hefty fines and operational shutdowns. As a result, companies are prioritizing MRO services to ensure compliance, which is expected to drive market growth. The financial implications of non-compliance further underscore the importance of maintaining rigorous maintenance schedules.

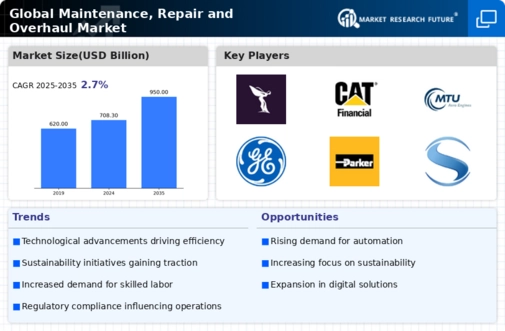

Technological Advancements

The integration of advanced technologies such as artificial intelligence, machine learning, and the Internet of Things is transforming the Global Maintenance, Repair and Overhaul Market. These technologies enhance predictive maintenance capabilities, allowing for timely interventions that reduce downtime and extend asset life. For instance, the use of AI-driven analytics can identify potential failures before they occur, thereby optimizing maintenance schedules. The market for predictive maintenance is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 25% in the coming years. This technological shift not only improves operational efficiency but also reduces costs associated with unplanned repairs, making it a crucial driver in the industry.

Global Supply Chain Dynamics

The complexities of global supply chains are influencing the Global Maintenance, Repair and Overhaul Market. Disruptions in supply chains can lead to delays in obtaining necessary parts and materials for maintenance and repair activities. As companies navigate these challenges, there is a growing recognition of the need for robust MRO strategies that ensure continuity of operations. The market is witnessing a shift towards localized sourcing and inventory management to mitigate risks associated with global supply chain vulnerabilities. This trend is expected to drive demand for MRO services that can adapt to changing supply chain dynamics, ultimately enhancing operational resilience.

Increased Focus on Sustainability

The rising emphasis on sustainability and environmental responsibility is reshaping the Global Maintenance, Repair and Overhaul Market. Companies are increasingly adopting eco-friendly practices, which include optimizing maintenance processes to reduce waste and energy consumption. The shift towards sustainable operations is not merely a trend; it is becoming a necessity as stakeholders demand greater accountability. For instance, industries are exploring ways to recycle materials and minimize the carbon footprint associated with maintenance activities. This focus on sustainability is likely to drive innovation in MRO services, as organizations seek to align their operations with environmental standards and consumer expectations.