Market Share

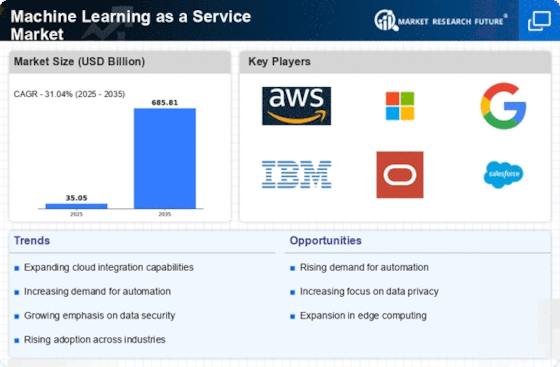

Machine Learning as a Service Market Share Analysis

The Machine Learning as a Service (MLaaS) market is a dynamic and competitive landscape, marked by various strategies utilized by vital participants to get and expand their market share. One noticeable strategy includes differentiation, where companies try to recognize their MLaaS contributions from contenders. This can be achieved through novel features, specialized applications, or proprietary algorithms. By offering something unique, companies aim to attract a particular client base that values the novel aspects of their MLaaS arrangement. Another pivotal strategy in market share situating is valuing. A few players decide on an expense leadership approach, situating themselves as the most affordable choice in the market. This appeals to cost-cognizant clients who focus on financial plan considerations. On the contrary, finest assessing strategies center around conveying top notch services with advanced features, appealing to clients ready to pay a premium for predominant performance and capabilities. Finding some kind of harmony among estimating and realised value is crucial for market share development.

Besides, an emphasis on client experience and satisfaction is integral to market share positioning. Companies that put resources into easy to use interfaces, responsive client service, and powerful training and onboarding programs create a positive client experience. Satisfied clients are bound to remain loyal and recommend the MLaaS supplier to other people. Verbal recommendations and positive surveys contribute significantly to building important areas of strength for a presence.

In addition to these strategies, geographic expansion is a critical consideration for global market players. Expanding into new locales allows companies to tap into different client bases and answer varying market needs. Localizing services to meet explicit regional necessities can be a crucial factor in gaining acceptance and confidence in new markets. By strategically entering and establishing a presence in developing markets, MLaaS suppliers can get additional market share and stay ahead of contenders.

Consistent innovation is a fundamental strategy that cannot be ignored. The field of machine learning is rapidly developing, and companies need to stay at the cutting edge of technological advancements. Regular updates, feature enhancements, and the integration of the latest algorithms guarantee that MLaaS suppliers remain relevant and serious in the fast-paced tech landscape. Companies that put resources into research and advancement to stay ahead of arising patterns are better situated to capture and retain market share.

Leave a Comment