Rising Disposable Incomes

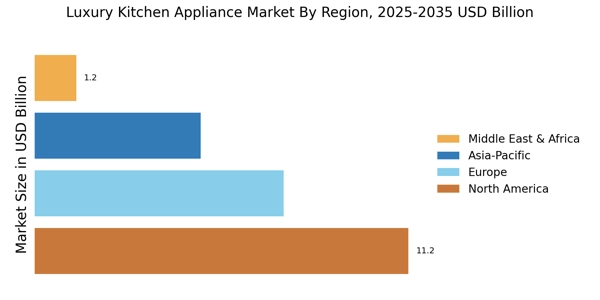

An increase in disposable incomes across various demographics is a key driver for the luxury kitchen appliance Market. As consumers find themselves with more financial flexibility, they are more inclined to invest in high-end kitchen appliances that offer superior quality and performance. Market data suggests that regions with a growing middle and upper class are witnessing a notable uptick in luxury appliance sales. This trend is particularly evident in emerging markets, where the appetite for premium kitchen solutions is expanding. Consequently, the rise in disposable incomes is expected to bolster the demand for luxury kitchen appliances, further propelling market growth.

Health and Wellness Trends

The Luxury Kitchen Appliance Market is increasingly influenced by the growing focus on health and wellness among consumers. As individuals become more health-conscious, there is a rising demand for appliances that facilitate healthier cooking methods, such as steam ovens and air fryers. This shift is supported by market data indicating that sales of health-oriented kitchen appliances have seen a significant increase, with a projected growth rate of approximately 15% over the next few years. Consumers are not only looking for functionality but also for appliances that align with their lifestyle choices. This trend is likely to continue shaping the luxury kitchen appliance landscape.

Technological Advancements

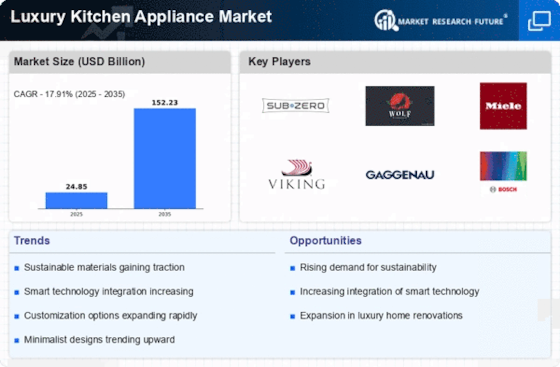

The Luxury Kitchen Appliance Market is experiencing a surge in technological advancements, which significantly enhances the functionality and appeal of high-end kitchen appliances. Innovations such as smart connectivity, artificial intelligence, and IoT integration are becoming increasingly prevalent. For instance, appliances that can be controlled via mobile applications or voice commands are gaining traction among consumers. This trend is reflected in the market data, which indicates that the smart kitchen appliance segment is projected to grow at a compound annual growth rate of over 20% in the coming years. As consumers seek convenience and efficiency, the demand for technologically advanced luxury appliances is likely to continue rising, thereby driving the overall market.

Aesthetic Appeal and Design

Aesthetic appeal and design are paramount in the Luxury Kitchen Appliance Market, as consumers increasingly prioritize the visual aspects of their kitchen spaces. High-end appliances are often viewed as integral components of kitchen decor, leading manufacturers to focus on creating visually stunning products. Market data reveals that consumers are willing to pay a premium for appliances that not only perform well but also enhance the overall aesthetic of their kitchens. This trend is particularly pronounced in luxury renovations, where design and functionality must coexist. As a result, the emphasis on aesthetic appeal is likely to drive demand for luxury kitchen appliances.

Sustainability and Eco-Friendly Products

Sustainability is becoming a crucial consideration in the Luxury Kitchen Appliance Market, as consumers increasingly seek eco-friendly products. The demand for energy-efficient appliances is on the rise, driven by a growing awareness of environmental issues. Market data indicates that energy-efficient kitchen appliances are projected to account for a significant share of the luxury segment, as consumers prioritize sustainability in their purchasing decisions. Manufacturers are responding by developing appliances that not only meet performance standards but also adhere to eco-friendly practices. This focus on sustainability is expected to play a pivotal role in shaping the future of the luxury kitchen appliance market.