Top Industry Leaders in the LTE & 5G Broadcast Market

The Competitive Landscape of LTE & 5G Broadcast Market

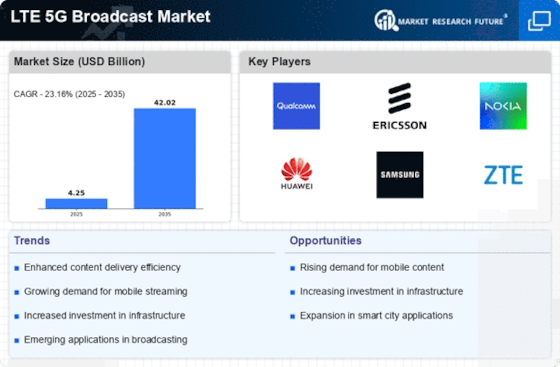

The convergence of mobile broadband and broadcast technologies is unlocking a new era of content delivery - the LTE & 5G broadcast market. This evolving landscape is attracting an array of players, each jockeying for position in a market. Here, we delve into the competitive dynamics, key players, and emerging trends shaping this exciting space.

Key Players:

- Qualcomm Technologies Inc. (US)

- SAMSUNG (South Korea)

- Cisco Systems Inc. (US)

- Huawei Technologies Co. Ltd. (China)

- ZTE Corporation (China)

- Telefonaktiebolaget LM Ericsson (Sweden)

- Nokia (Finland)

- NEC Corporation (Japan)

- ENENSYS Technologies (France)

- Athonet srl (Italy)

- AT&T (US)

- Intel Corporation (US)

Factors for Market Share Analysis:

- Network infrastructure investment: Extensive 5G network rollouts and upgrades to support LTE broadcast capabilities will play a significant role. Players with strong financial backing and infrastructure expertise will hold an advantage.

- Spectrum availability: Access to dedicated spectrum for broadcast services will be crucial. Governments and regulatory bodies will have a significant say in spectrum allocation, impacting market dynamics.

- Content partnerships: Building robust content libraries and forging strategic partnerships with media giants will be key to attracting and retaining users. The ability to offer diverse and high-quality content will be a differentiator.

- Device compatibility: Ensuring widespread device compatibility with broadcast functionalities will be vital for mass adoption. Collaboration with chipset manufacturers and device makers will be critical in this regard.

- Regulatory landscape: Navigating the evolving regulatory landscape around spectrum allocation, content rights, and data privacy will be crucial. Players who adapt quickly and comply with regulations will gain an edge.

New and Emerging Companies:

Several startups are disrupting the market with innovative approaches. Companies like Mobisoft and Cellcast are focusing on delivering targeted content to specific user groups, while companies like Bitmovin and Broadcast Bridge are developing software solutions for efficient broadcast management and delivery. These niche players bring fresh perspectives and agility, potentially challenging established players in specific segments.

Current Investment Trends:

- Focus on 5G infrastructure: Major investments are pouring into 5G network rollouts, with an increasing focus on integrating broadcast capabilities.

- Collaboration and partnerships: Players are actively seeking strategic partnerships across the value chain, from infrastructure providers to content creators, to accelerate market penetration.

- Research and development: Significant investments are being made in R&D, particularly in areas like single-frequency networks, network slicing, and advanced content delivery protocols.

- Focus on emerging markets: Growing smartphone penetration and data consumption in developing economies are attracting investments in building broadcast infrastructure and local content creation.

Latest Company Updates:

Dec 20, 2023: AT&T announces pilot launch of 5G Broadcast in select US cities, partnering with Sinclair Broadcast Group for local news and entertainment content.

Nov 15, 2023: Deutsche Telekom invests in 5G Broadcast infrastructure, aiming for nationwide coverage by 2025.

Oct 27, 2023: China Mobile launches commercial LTE Broadcast service, initially focusing on public safety and emergency alerts.