Increased Mobile Data Consumption

The lte 5g-broadcast market is significantly influenced by the rising mobile data consumption in the GCC. With the increasing reliance on mobile devices for content consumption, the demand for efficient broadcasting solutions is escalating. Reports indicate that mobile data traffic in the region is expected to grow by 50% annually, necessitating the adoption of advanced broadcasting technologies. This trend presents a lucrative opportunity for the lte 5g-broadcast market to provide solutions that can handle the growing data demands while ensuring high-quality content delivery. The ability to efficiently manage this data surge will be critical for market players.

Advancements in Broadcasting Technology

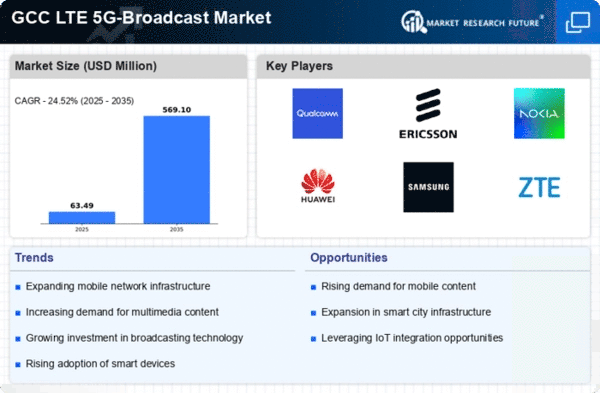

Technological advancements play a crucial role in shaping the lte 5g-broadcast market. Innovations such as improved encoding techniques and enhanced transmission methods are enabling broadcasters to deliver superior quality content more efficiently. The integration of artificial intelligence and machine learning into broadcasting systems is also enhancing content personalization and viewer engagement. As the GCC region invests heavily in digital infrastructure, the lte 5g-broadcast market stands to benefit from these technological improvements. The market is expected to grow at a CAGR of 15% over the next five years, driven by these advancements that enhance the overall broadcasting experience.

Growing Demand for High-Quality Streaming

The lte 5g-broadcast market is experiencing a surge in demand for high-quality streaming services across the GCC region. As consumers increasingly seek seamless access to high-definition content, the need for robust broadcasting solutions becomes paramount. This trend is further supported by the proliferation of smart devices and the expansion of internet connectivity. According to recent data, the number of mobile broadband subscriptions in the GCC is projected to reach 100 million by 2026, indicating a substantial market opportunity. The lte 5g-broadcast market is poised to capitalize on this demand, providing enhanced streaming capabilities that cater to the evolving preferences of consumers.

Rising Competition Among Service Providers

The competitive landscape of the lte 5g-broadcast market is intensifying as more service providers enter the arena. This competition is fostering innovation and driving down costs, ultimately benefiting consumers. As companies strive to differentiate their offerings, there is a notable increase in the development of unique broadcasting solutions tailored to specific audience needs. The lte 5g-broadcast market is likely to witness a flurry of new entrants, each aiming to capture market share. This competitive dynamic is expected to lead to enhanced service quality and a broader range of content options for consumers in the GCC.

Government Initiatives for Digital Transformation

Government initiatives aimed at digital transformation are driving the growth of the lte 5g-broadcast market in the GCC. Various national strategies are being implemented to enhance digital infrastructure and promote the adoption of advanced technologies. These initiatives often include funding for research and development, as well as incentives for companies to innovate within the broadcasting sector. The lte 5g-broadcast market is likely to benefit from these supportive policies, which aim to position the region as a leader in digital broadcasting. As a result, the market is expected to see increased investment and development in the coming years.