Increased Industrial Automation

The Low Voltage Electric Motor Market is witnessing a surge in demand driven by increased industrial automation. As industries adopt automation technologies to enhance productivity and efficiency, the reliance on low voltage electric motors in various applications is growing. These motors are essential components in automated systems, including conveyors, robotics, and packaging machinery. Data suggests that the automation market is projected to grow substantially, which will likely lead to a corresponding increase in the demand for low voltage electric motors. This trend indicates a robust future for the Low Voltage Electric Motor Market as industries continue to embrace automation.

Growth in Electric Vehicle Adoption

The Low Voltage Electric Motor Market is benefiting from the rapid growth in electric vehicle (EV) adoption. As the automotive sector transitions towards electrification, low voltage electric motors play a crucial role in various applications, including traction and auxiliary systems. The International Energy Agency reports that global electric vehicle sales are expected to reach unprecedented levels, which will likely drive demand for low voltage electric motors. This trend not only supports the automotive industry's shift towards sustainability but also presents significant opportunities for manufacturers within the Low Voltage Electric Motor Market to expand their product offerings.

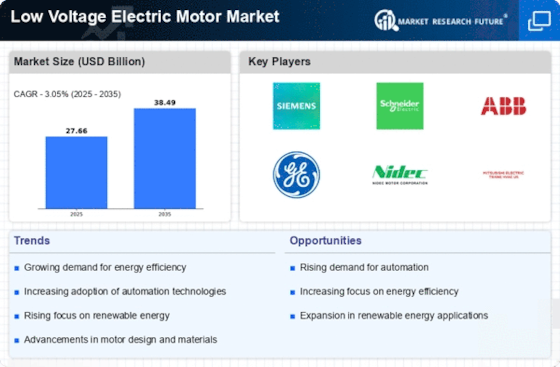

Rising Demand for Energy Efficiency

The Low Voltage Electric Motor Market is experiencing a notable surge in demand for energy-efficient solutions. As industries strive to reduce operational costs and minimize environmental impact, the adoption of low voltage electric motors has become increasingly prevalent. According to recent data, energy-efficient motors can reduce energy consumption by up to 30% compared to traditional models. This shift not only aligns with global sustainability goals but also enhances the competitiveness of businesses. The growing emphasis on energy efficiency is likely to drive innovation within the Low Voltage Electric Motor Market, prompting manufacturers to develop advanced technologies that meet stringent energy standards.

Expansion of Renewable Energy Sources

The Low Voltage Electric Motor Market is poised for growth due to the expansion of renewable energy sources. As countries invest in wind, solar, and hydroelectric power, the demand for low voltage electric motors in these applications is expected to rise. For instance, low voltage motors are integral to the operation of wind turbines and solar tracking systems. The International Energy Agency indicates that renewable energy capacity is projected to increase significantly, which will likely create new opportunities for the Low Voltage Electric Motor Market. This trend suggests a shift towards cleaner energy solutions, further driving the adoption of low voltage electric motors.

Technological Advancements in Motor Design

Technological advancements are reshaping the Low Voltage Electric Motor Market, leading to the development of more efficient and reliable motor designs. Innovations such as improved materials, enhanced cooling systems, and advanced control technologies are contributing to the performance and longevity of low voltage electric motors. For example, the introduction of permanent magnet motors has shown to increase efficiency levels significantly. As industries seek to optimize their operations, the demand for these advanced motor designs is likely to escalate. This trend indicates a competitive landscape within the Low Voltage Electric Motor Market, where manufacturers must continuously innovate to meet evolving customer needs.