Market Trends

Key Emerging Trends in the Low Carbon Hydrogen Market

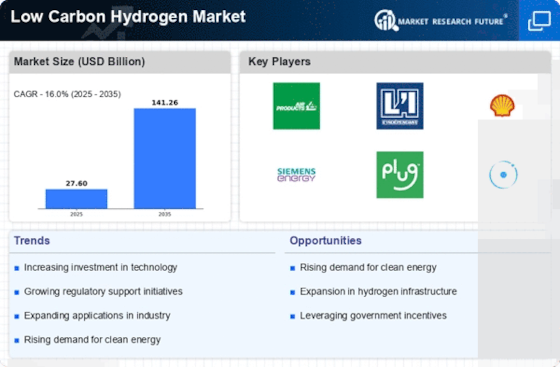

The market trends in low carbon hydrogen are experiencing notable shifts influenced by global efforts to reduce carbon emissions, advancements in clean energy technologies, and a growing emphasis on sustainable fuel alternatives. A significant trend in this market is the increasing demand for low carbon hydrogen as a key player in the transition towards clean energy. Low carbon hydrogen, produced through processes such as electrolysis using renewable energy sources, offers a sustainable alternative to conventional hydrogen production methods, which often involve carbon-intensive processes like steam methane reforming. This trend reflects the broader commitment to decarbonizing industries, transportation, and energy systems by replacing conventional hydrogen with a more environmentally friendly option.

Moreover, there is a growing focus on creating hydrogen hubs and infrastructure to support the production, storage, and distribution of low carbon hydrogen. Governments and private entities are investing in building a robust hydrogen ecosystem that includes production facilities, storage solutions, and a network of distribution pipelines or transportation options. This infrastructure trend is crucial in scaling up the adoption of low carbon hydrogen across various sectors, from industry to transportation, contributing to the overall advancement of hydrogen as a clean energy carrier.

Customization is emerging as another significant trend in the low carbon hydrogen market. Different industries and applications have unique requirements for hydrogen specifications, whether it be purity levels or pressure. Low carbon hydrogen suppliers are working towards providing customized solutions tailored to meet the specific needs of diverse end-users. This trend allows industries to integrate low carbon hydrogen seamlessly into their processes, supporting the transition towards cleaner energy solutions.

Technological advancements in electrolysis and hydrogen production technologies are playing a pivotal role in reshaping the low carbon hydrogen market. Innovations such as high-efficiency electrolyzers, advanced catalysts, and integrated energy storage solutions contribute to making low carbon hydrogen production more efficient and cost-effective. These advancements address challenges related to the scalability and competitiveness of low carbon hydrogen, making it a more viable option for widespread adoption.

Furthermore, the market is witnessing a surge in international collaborations and partnerships to accelerate the development and deployment of low carbon hydrogen technologies. Countries and companies are working together to share knowledge, invest in joint research and development initiatives, and create a global framework for the production and trade of low carbon hydrogen. This collaboration trend is essential in fostering a collective approach towards addressing climate change and achieving carbon reduction goals on a global scale.

In terms of market dynamics, competition in the low carbon hydrogen industry is intensifying. Companies are investing in technology, infrastructure, and international partnerships to gain a competitive edge. Meeting regulatory standards, ensuring the scalability of low carbon hydrogen production, and developing cost-effective solutions are critical factors for success in this competitive market. The sector also faces challenges related to the cost competitiveness of low carbon hydrogen compared to conventional hydrogen and the need for supportive government policies to incentivize its adoption.

Challenges in the low carbon hydrogen market include the need for continued research and development to enhance production efficiency, address infrastructure gaps, and bring down the costs associated with low carbon hydrogen technologies. Additionally, ensuring a consistent and sustainable supply chain of renewable energy sources for electrolysis is crucial for the long-term viability of low carbon hydrogen.

Leave a Comment