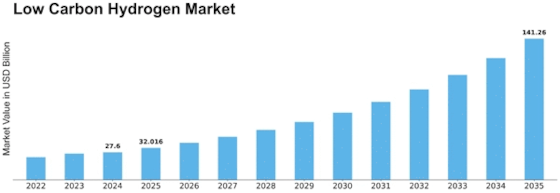

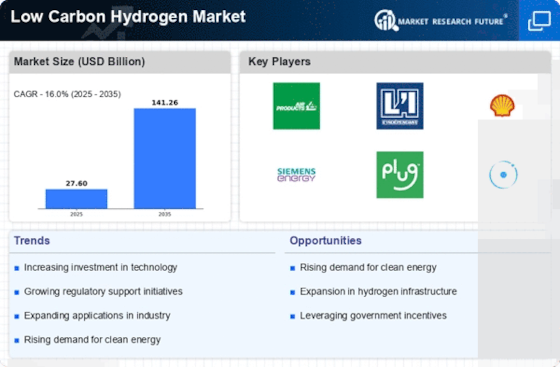

Low Carbon Hydrogen Size

Low Carbon Hydrogen Market Growth Projections and Opportunities

The low carbon hydrogen market is shaped by a convergence of factors that collectively influence its growth and dynamics within the global economy. Economic conditions, environmental goals, technological advancements, and energy transition initiatives play pivotal roles in determining the trajectory of the low carbon hydrogen industry. Economic stability is a fundamental driver for the low carbon hydrogen market, as industries seek cost-effective and sustainable energy solutions. Low carbon hydrogen, produced with minimized carbon emissions, aligns with the growing demand for clean energy alternatives. During periods of economic growth, increased investments in renewable energy projects and decarbonization efforts contribute to higher demand for low carbon hydrogen. Conversely, economic downturns may impact the pace of such investments.

Environmental considerations are a primary force shaping the low carbon hydrogen market. With a focus on reducing carbon emissions and combating climate change, governments, industries, and consumers are increasingly embracing low carbon hydrogen as a clean and versatile energy carrier. The transition toward renewable energy sources, such as wind and solar, for hydrogen production aligns with global sustainability goals. Initiatives like the Green Hydrogen Economy are driving the market, aiming to replace conventional hydrogen production methods with environmentally friendly alternatives.

Technological advancements in hydrogen production, storage, and transportation contribute to the efficiency and scalability of the low carbon hydrogen market. Innovations in electrolysis, particularly using renewable electricity to split water into hydrogen and oxygen, play a crucial role in producing green hydrogen. Advanced storage and transportation technologies address the challenges associated with handling and distributing hydrogen. Research and development in fuel cells and hydrogen-based applications further enhance the overall value chain of low carbon hydrogen, making it increasingly competitive with conventional hydrogen production methods.

Energy transition initiatives and policy frameworks significantly impact the low carbon hydrogen market. Governments worldwide are implementing strategies to accelerate the adoption of low carbon hydrogen, offering financial incentives, subsidies, and regulatory support. The European Union's Hydrogen Strategy, for example, aims to establish a robust hydrogen economy, while countries like Japan and South Korea are investing heavily in hydrogen infrastructure and research. Policy measures, such as carbon pricing and emission reduction targets, create a conducive environment for the growth of the low carbon hydrogen market.

Global energy demand trends and the need for decarbonization influence the market for low carbon hydrogen. As industries, transportation, and power sectors seek alternatives to reduce their carbon footprint, low carbon hydrogen emerges as a versatile solution. Its application extends to sectors such as manufacturing, transportation, and power generation, contributing to a diversified and growing market demand. The shift toward hydrogen-based solutions in heavy industries like steel and chemical manufacturing further propels the market forward.

Market competition in the low carbon hydrogen industry is shaped by factors such as production costs, technological efficiency, and policy alignment. Companies involved in hydrogen production, storage, and distribution compete based on the cost-effectiveness of their solutions and the environmental impact of their processes. Innovations in electrolysis technology, coupled with economies of scale, contribute to cost competitiveness. Companies that align with government policies, support energy transition goals, and demonstrate sustainability in their operations are likely to gain a competitive edge in the evolving low carbon hydrogen market.

Leave a Comment