Logistics Supply Chain Size

Logistics & Supply Chain Market Growth Projections and Opportunities

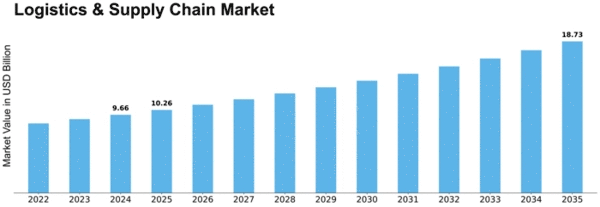

The logistics and supply chain market is dynamic and multi-layered, influenced by many factors. These factors shape the business landscape, affecting companies, customers, and the global economy. Each 2022, the logistics and supply chain market was worth USD 8.6 billion. Logistics & Supply Chain is expected to grow from USD 9.1 Billion in 2023 to USD 14.7 Billion in 2032, a CAGR of 6.20%.

Mechanical advances affect logistics and supply chain markets. Logistics and supply chain executives are more productive and seamless as innovation advances. Computers, artificial intelligence, and data analysis are transforming supply chain operations, accelerating courses, reducing lead times, and lowering functional costs. Companies that adopt these mechanical advances improve their supply chain performance.

Globalization is another major market aspect affecting logistics and supply chain. Demand for continuous cross-line transit and appropriation has increased as enterprises expand globally. The development of complex global supply chains has required companies to adapt and improve their logistics processes to address issues connected to foreign laws, traditions, and social differences.

The administrative climate shapes logistics and supply chain markets. State-run administrations worldwide implement transportation, exchange, and supply chain policies. Organizations must follow these principles to avoid supply chain penalties and disruptions. To maintain legal consistency and productivity, firms must adapt their logistical methods when administrative systems change.

Market demand and customer expectations also affect logistics and supply chain. As customers prefer faster delivery, continuing support, and sustainable practices, companies need adapt their supply chain procedures. Online commerce had a major role in shaping client expectations, necessitating coordinated and flexible logistics systems to meet modern market demands.

The logistics and supply chain business is constantly affected by finance. Financial slumps can reduce customer spending and demand, affecting stock and transportation volumes. However, financial growth can increase trade and production, reducing supply chain constraints. Financial markers and logistics systems should be screened to discover monetary alterations' challenges.

Recently, market consideration has focused on natural manageability. Growing awareness of environmental change and ecological issues puts pressure on companies to adopt eco-friendly supply chain procedures. Waste reduction, fossil fuel reduction, and conscientious material selection are included. Maintainability helps companies preserve nature, build brand awareness, and attract eco-conscious customers.

Leave a Comment